No matter how much you love what you do, it’s likely you’re working for one reason: money.

If you run your own business, you know the ongoing expenses that can eat into your pockets. From employee wages to office supplies, it can be overwhelming to understand how much you’ll actually take home after all these expenses.

Before you phone your accountant, there is one metric that can help you assess your company’s financial success: net income. And the best part is, you don’t have to be a math whiz to figure it out. Instead, you’ll just need the net income formula.

To learn more about net income and how you can calculate it yourself, follow this comprehensive guide.

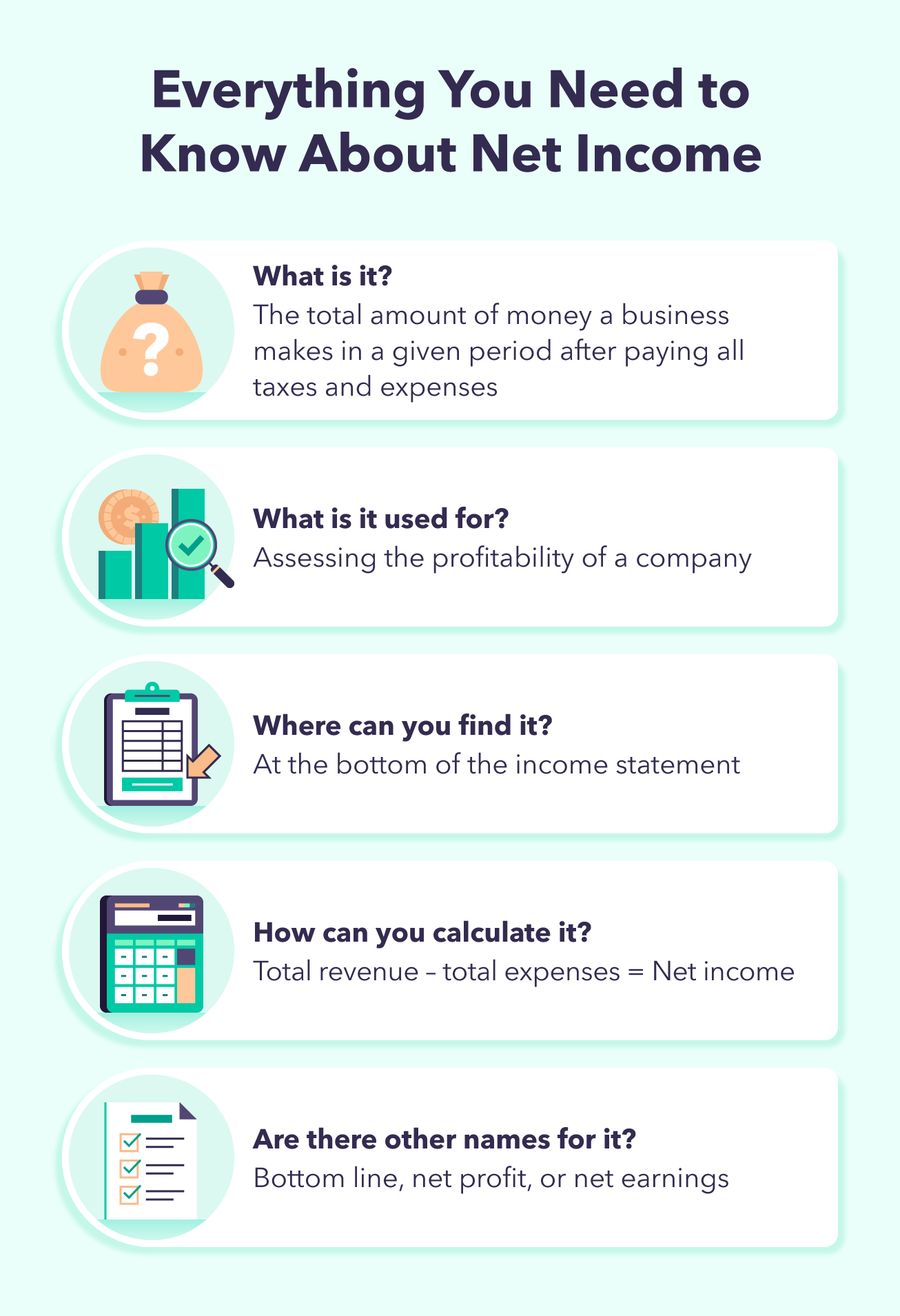

What Is Net Income?

Net income is the total amount of money a business earns after paying all taxes and expenses in a given period.

You can use this number to:

- Calculate a business’s earnings per share

- Assess a business’s financial health

- Determine an individual’s annual income after taxes

Net income may also be referred to as a company’s bottom line, net profit, or net earnings. You can find this number at the bottom of your business’s income statement. For an individual, net income is a term often used to describe the amount of money you make after taxes and retirement contributions.

Gross Income vs. Net Income: What’s the Difference?

While both numbers refer to a business’s profits, gross income and net income represent different phases of the buying and selling process. For example, gross income is a business’s earnings after deducting the cost of producing and selling products, also known as the cost of goods sold (COGS).

To calculate your gross income, follow the gross income formula:

- Gross Income = Total Revenue – Total Cost of Goods Sold

Now that you know the difference between gross and net income, let’s take a look at operating income, another commonly used measurement of profitability.

Operating Income vs. Net Income: What’s the Difference?

Operating income represents the income your business generates after any operating expenses. Operating expenses include payroll, utilities, office supplies, and property taxes.

To calculate your operating income, follow the operating income formula:

- Operating Income = Gross Income – Operating Expenses

By calculating your operating income, you’ll know how much money your company generates from its day-to-day operations before paying taxes or any other one-off expenses.

The Net Income Formula Explained

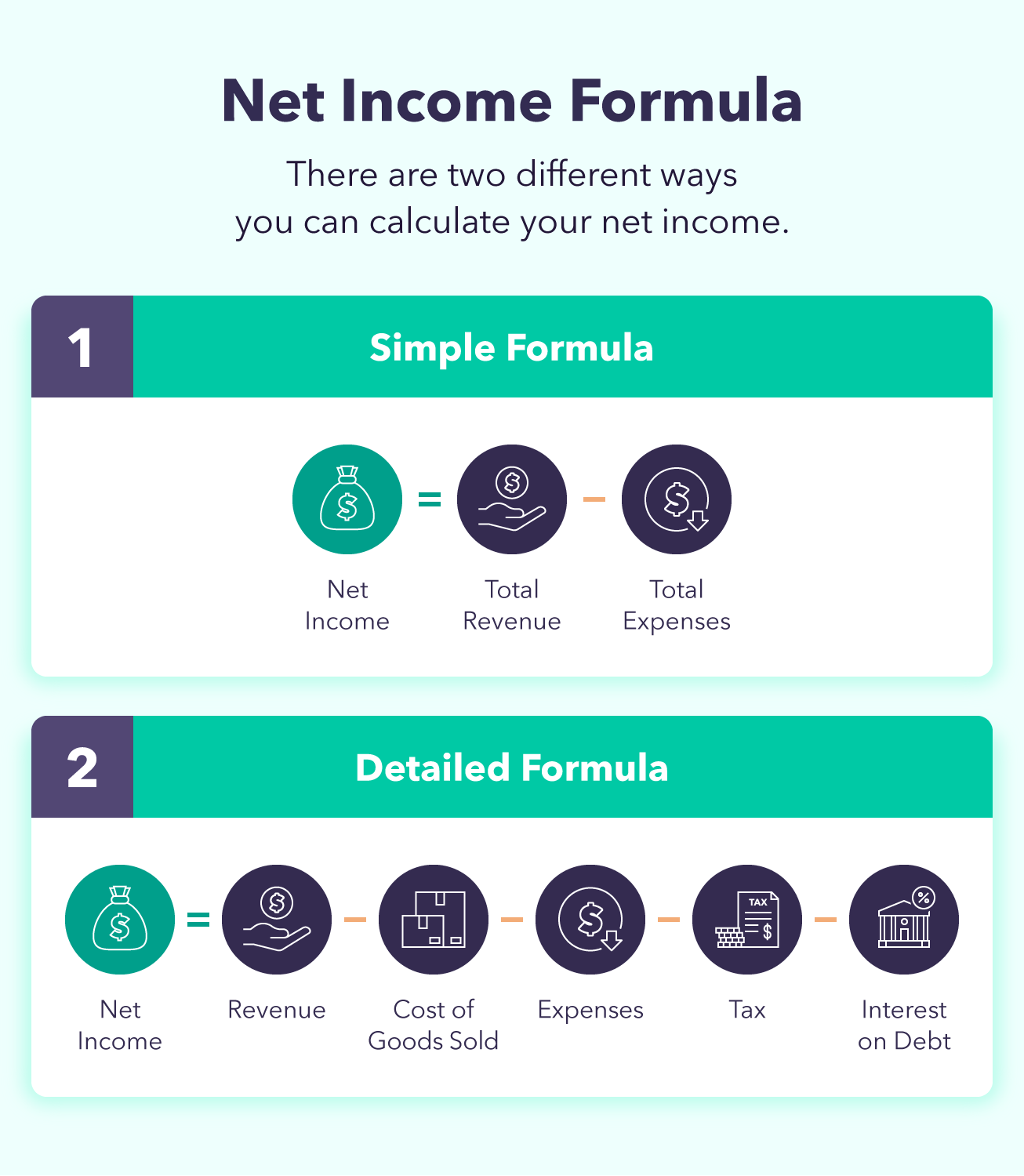

Now that you’ve learned about net vs. gross income and net vs. operating income, you’re probably wondering how you can easily calculate your business’s net income.

You can quickly determine your net income by using this simple formula:

- Net Income = Total Revenues – Total Expenses

If you’d like to break it down into more specific steps, you can use this detailed formula to calculate net income instead:

- Net Income = Revenue – Cost of Goods Sold – Expenses – Taxes – Interest on Debt

Before you reach for your calculator and financial statements, continue reading to learn more about each item used to calculate your net income.

Revenue

Sometimes referred to as net sales, revenue is the total amount of money your company earns from selling goods and services in a given time. In addition to revenue generated from your business’s core activities, you may also have non-operating revenue. Examples of non-operating revenue include:

- Interest revenue

- Revenue from the sale of assets or equipment

- Dividend income

You can find how much revenue you have at the top of your income statement.

Cost of Goods Sold

COGS is the cost it takes to produce and sell your company’s goods. COGS includes:

- Cost of raw materials

- Wages for production workers

- Equipment costs

- Repair and maintenance costs

- Utilities for manufacturing facilities

- Shipping costs

Depending on your business, these costs may fluctuate based on production output, cost of materials, and other economic factors such as inflation.

Expenses

Expenses are the costs your company faces during its typical course of business and are reported on your income statement. Some common examples of expenses include:

- Advertising and marketing expenses

- Employee training expenses

- Legal fees

- Employee benefits programs

- Insurance

- Office leases

It’s important to note that some expenses may also be tax-deductible if they are defined as ordinary and necessary for business operations.

Taxes

Two things in life are certain: death and taxes. When calculating your net income, the business taxes you pay will depend on the structure of your business and where you live. To break things down, here is a general overview of the taxes you may have to pay:

- Income tax: You’ll pay income tax on your earned taxable income throughout the year.

- Estimated taxes: You’ll pay this tax on income that is not subject to withholding, including interest, dividends, and capital gains.

- Self-employment tax: If you work for yourself, you’ll pay this tax to contribute to your Medicare and Social Security benefits.

- Employment taxes: As an employer, you’ll pay various taxes, including Social Security, Medicare, federal income tax withholding, and federal unemployment (FUTA) tax.

- Excise taxes: You may pay these taxes depending on what your business does. Examples include fuel, environmental, and air transportation taxes.

To figure out what taxes apply to you, check out this guide from the Internal Revenue Service.

Interest on Debt

When calculating your net income, you’ll want to account for any interest that needs to be paid on outstanding debt. Examples of debt that may incur interest include:

Interest on debt is generally calculated by multiplying the interest rate and the outstanding principal amount of debt.

How To Calculate Net Income

Whether you want to know the net income for yourself or your business, there are different ways you can find and calculate your net income. Follow along to learn how to determine your net income using a net income formula and financial statements.

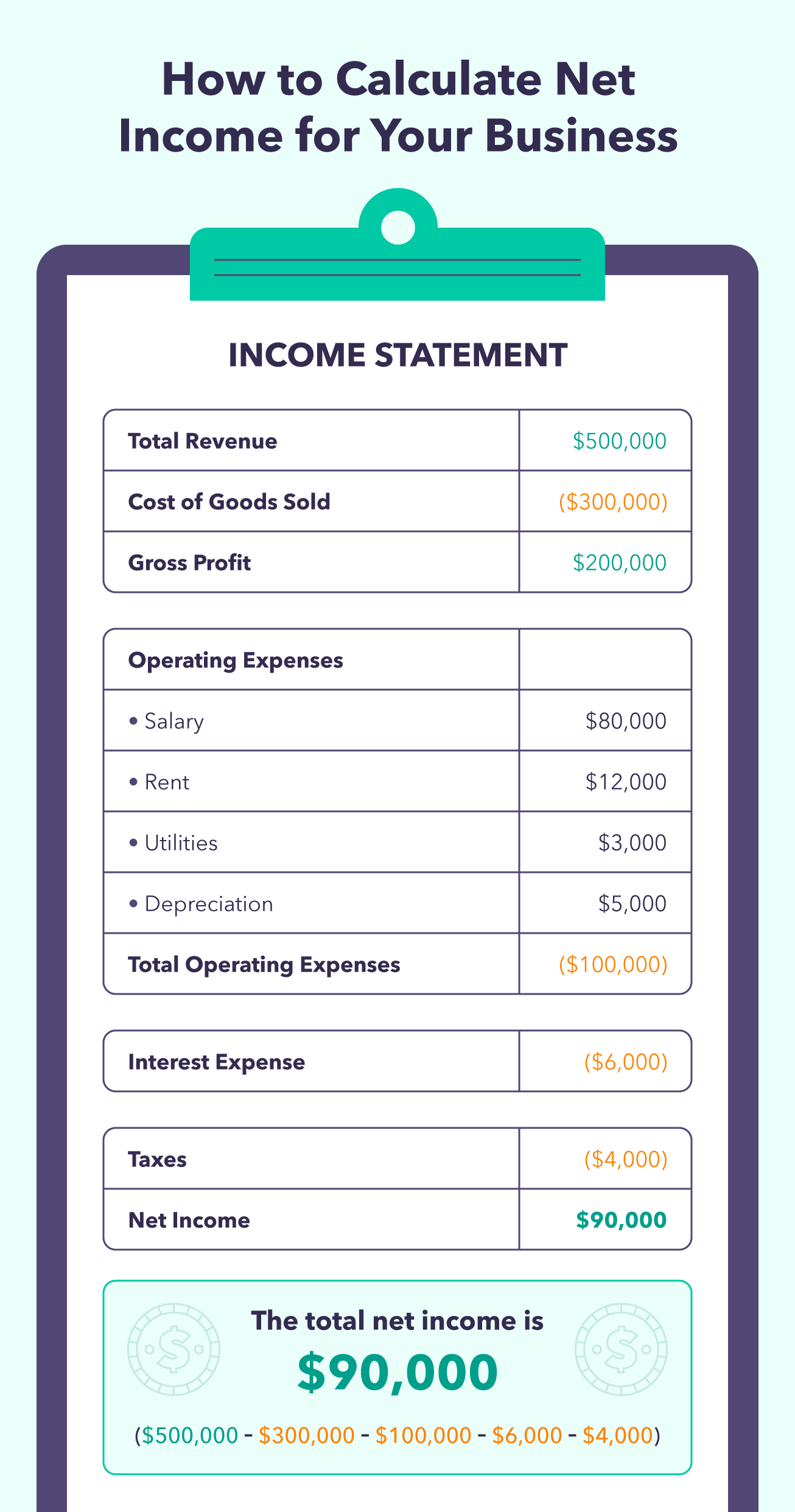

Calculating Net Income for Businesses

To better understand how to calculate a business’s net income, let’s look at this net income example for Business A. Let’s say at the end of the accounting period, Business A has:

- Revenue of $500,000

- Cost of goods sold of $300,000

- Expenses of $100,000

- Debt payments of $6,000

- Tax payments of $4,000

Business A’s net income would equal $90,000 ($500,000 – $300,000 – $100,000 – $6,000 – $4,000).

Calculating Personal Net Income Using Tax Returns

Although personal net income is not explicitly stated on your tax return, you can calculate it yourself using numbers from your individual income tax return, also known as Form 1040. To do so, you’ll subtract the number listed in Line 24 (Total Tax) from Line 15 (Taxable Income). Here’s an example:

- Line 15: $85,000

- Line 24: $10,000

Your net income would equal $75,000 ($85,000 – $10,000).

Calculating Personal Net Income Using Pay Stubs

The number you see on your paycheck is equivalent to your net income for that pay period. It will include your earnings minus taxes and, if applicable, retirement contributions. For example, let’s take a look at Employee A’s pay stub:

- Earnings of $4,000

- Taxes of $800

- Retirement contribution of $250

Employee A’s net income would equal $2,950 ($4,000 – $800 – $250).

Now that you’ve learned the net income formula, it’s time to jump in and start calculating. Then you can use your findings to make informed business decisions, improve your bottom line, and ultimately increase your net income, allowing you to achieve your long-term financial goals.

Sign up for MintFAQs About Net Income

Have more questions? If so, follow along to learn the answers to common questions about net income and how you can calculate it yourself.

While both represent an excess of income compared to expenses, their definitions are contextually different. For example, the word “profit” describes any revenue that remains after subtracting your expenses. On the other hand, net income is a specific number you can find on the bottom line of an income statement or by using the net income equation.

Yes, net income is the amount of money left over after subtracting taxes, cost of goods sold, interest on debt, and total expenses.

With an understanding of gross vs. net income, you can calculate your net income by taking your gross income and subtracting your expenses, taxes, and interest on debt.

Gross profits are higher. Because net income subtracts your expenses, taxes, and interest on debt, it will be a lower number than gross profits.

You can find your net income at the bottom of your income statement.

The post Net Income Formula: How To Calculate Net Income appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/LlTfznj

Comments

Post a Comment

We will appreciate it, if you leave a comment.