When Bank of America acquired Merrill Lynch in 2009, its investment arm was renamed Merrill (dropping the Lynch).

Merrill itself is a Bank of America company with three investment options – Merrill Edge Self-Directed, Merrill Guided Investing, and Merrill Guided Investing with an advisor.

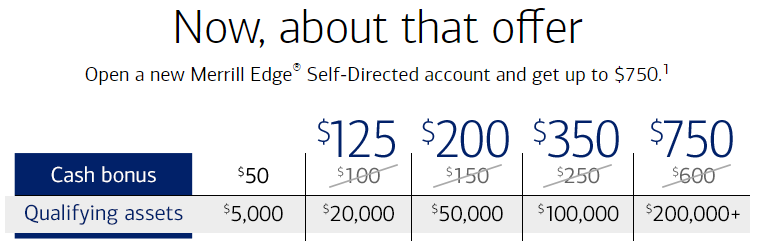

If you’re interested in opening a Merrill Edge Self-Directed account, there are some juicy bonuses available if you are able to deposit a sizable chunk of cash into the account.

For many brokerages, this method is the best way to get extra cash to try out a new brokerage.

Table of Contents

How to get up to $750 from Merrill Edge

The bonus is routine if you’re familiar with brokerage bonuses.

Open a new Merrill Edge account with the promotion code 750ME and then transfer in new net assets within 45 days. These have to be new to the Bank of America ecosystem – so it can’t come from other accounts at Bank of America or Bank of America Private Bank or Merrill Lynch Pierce Fenner & Smith (MLPF&S), which is an investment advisory service offered by Merrill.

After 90 days of meeting the funding criteria, the cash reward is calculated based on the “qualifying net new assets” in your account (irrespective of any losses or gains due to trading or market volatility).

The bonus is based on this schedule:

| Qualifying Assets | Cash Bonus |

|---|---|

| $5,000 – $19,999 | $50 |

| $20,000 – $49,999 | $125 |

| $50,000 – $99,999 | $200 |

| $100,000 – $199,999 | $350 |

| $200,000 or more | $750 |

Merrill Edge Commissions & Fees

Getting a cash bonus for opening an account isn’t worth it if the brokerage hits you with a lot of commissions and fees. Fortunately, Merrill Edge doesn’t do that. Their fee structure is good.

You get unlimited $0 online stock and ETF trades with no balance minimums whatsoever. If you want a broker assisted trade, that’ll cost $29.95.

If you are into options trading, those are $0 as well plus 65 cents per contract. Broker-assisted trades are again $29.95 plus 65 cents per contract.

Merrill Edge is competitive with other low cost brokers in terms of their fees and commission schedule.

How does this offer compare?

We maintain a list of the best brokerage promotions and this is comparable if you only have a few hundred thousand in assets to transfer. The downside of Merrill’s bonus schedule is that it tops out at $200,000. You could transfer a million dollars in assets and it would still be only worth, in bonus, as transferring $200,000.

In comparison, if you were to go after Ally Invest’s bonus, and had more in assets, you can get up to $3,000. Here is Ally Invest’s bonus schedule:

| Deposit or Transfer Amount |

Your Bonus |

|---|---|

| $10,000 – $24,999 | $100 |

| $25,000 – $99,999 | $250 |

| $100,000 – $249,999 | $300 |

| $250,000 – $499,999 | $600 |

| $500,000 – $999,999 | $1,200 |

| $1,000,000 – $1,999,999 | $2,000 |

| $2,000,000 or more | $3,000 |

As you can see, if you had $200,000 – you’d be better off with Merrill since you could get $750 vs. only $300. If, however, you had $500,000 or more – you’d get more in bonus from Ally Invest.

Also worth considering is that some brokerages will reimburse you the ACAT fee. ACAT is the system used to transfer assets between brokerages and most brokerages will charge you to leave. Ally Invest will reimburse you up to $75 in those fees when you come to them with at least $2,500 in assets – which further improves the effective bonus.

Unfortunately, Merrill Edge doesn’t reimburse ACAT fees.

The post Merrill Edge Promotions – up to $750 Cash appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/6DBHvfk

Comments

Post a Comment

We will appreciate it, if you leave a comment.