If you overhear a conversation about bears and bulls, it might not be about someone’s recent trip to the zoo. In fact, they may be talking about bull and bear markets. After all, 55 percent of Americans invest in the stock market. But even if you’ve invested before, you may be asking yourself, “What is the difference between a bull and bear market?”

For an in-depth understanding of the differences between a bull vs. bear market and how these trends affect investment activities, continue reading this guide.

What Is a Bull Market?

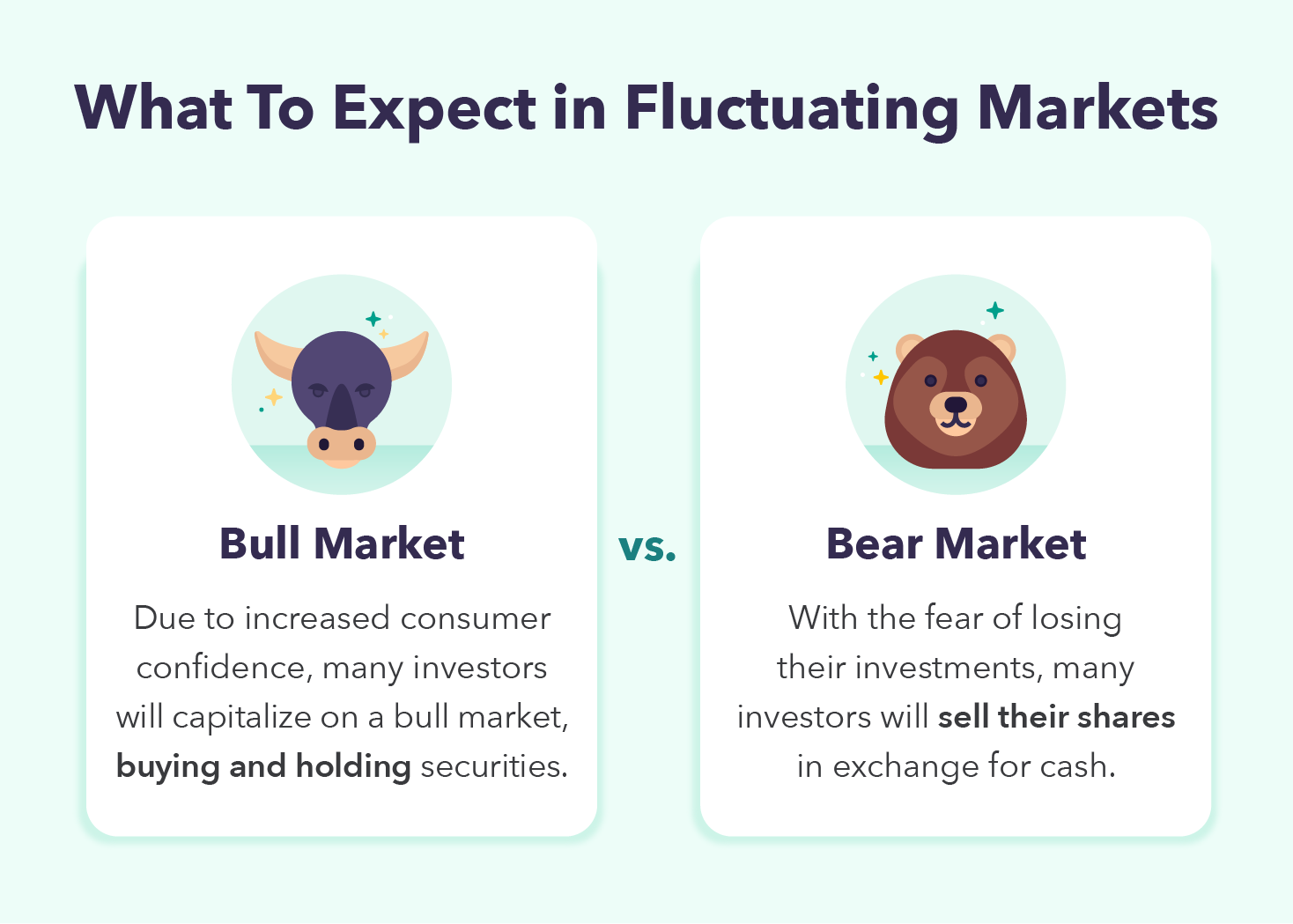

A bull market is a time of economic growth and consumer confidence. During this time, the economy is thriving, and there are low unemployment rates. In a bullish market, you can expect stock prices to increase over 20 percent for an extended period. Because of this, investors are likely to buy and hold onto their stocks.

What Is a Bear Market?

A bear market is the opposite of a bullish market, representing an economic downturn and high unemployment rates. When a bear market occurs, stock prices will fall over 20 percent for a long period of time. These plummeting stock prices will lead many investors to sell their securities for the safety of cash.

Differences Between a Bull and Bear Market

As you can probably guess, there are some significant differences when comparing bear vs. bull markets. However, to better understand the economic conditions that lead to each one — and what to look out for to protect your capital — it’s important to highlight a few key differences.

Investor Attitudes

When it comes to bull and bear trading, investor attitudes tend to change depending on the current market. In a bullish market, investors are usually optimistic and eager to capitalize on the profits. To do so, investors will buy and hold onto their securities of choice, hoping to earn money as the prices trend upward.

In a bearish market, it is quite the opposite. Instead, investors are doubtful and not willing to risk losing their investments. To avoid losing money, investors will sell whatever they can and leave the market in favor of cash.

Supply and Demand

Supply and demand are the bread and butter of economics, so it’s good to know how they’re affected by bear and bull markets. For example, a bull market has a considerable demand for equities and securities. Because of this, there ends up being a lower supply of stocks, further increasing the price.

During a bear market, you can expect to see the opposite. With many investors selling their stocks, the supply increases while the demand diminishes, sinking the stock price and leading investors to fear losing their investments.

Economic Activity

The final difference to note when comparing a bullish vs. bearish market is that bull markets are usually associated with strong economies and bear markets with economies in trouble. For example, in a bear market, many businesses may be unable to record a high net income due to consumers being less willing to spend.

On the flip side, most people will likely have more disposable income for guilt-free spending in a bull market, increasing their willingness to spend it. This behavior can help businesses thrive and therefore strengthen the economy.

What Investors Should Do in a Bull vs. Bear Market

Now that you know the differences between a bear vs. bull market, here’s the big question: What should you do in each market? Follow along, and let’s take a look at each.

What To Do in a Bull Market

In a bull stock market, you may hear people saying that you need to take advantage of the rising prices. One method many investors use is the buy-and-hold strategy. When practicing this investment strategy, you will buy stocks with the intention of holding them while the prices increase.

However, this is easier said than done. It’s good to remember that all investing comes with some risk. Because of this, many investors may choose to grow their money slowly using low-risk investments.

What To Do in a Bear Market

Bear stock markets are trickier, as it’s hard to say which companies may survive and bounce back with new profits and which ones go under — and take your capital with them. However, if you’re investing in the short term, it’s a good idea to research which companies are likely to survive and only consider investing in those.

And remember, there is always a good degree of risk when investing in a volatile market. If you’re in it for the long haul (like an index fund or retirement account), it’s best to avoid panic selling. Chances are, as the history of the stock market has proved, the economy will recover and your holdings will begin to appreciate again.

The Bottom Line

Before you start investing, here’s what to remember about bull markets vs. bear markets:

- A bull market is when stocks go up in value, in turn improving the economy and employment rates. They usually last a couple of years.

- A bear market is when stocks are losing value, the economy looks uncertain, and unemployment might increase. Bear markets tend to last just a few months but can be longer.

- Investor attitudes have a lot to do with the way markets perform — investors might feel bullish, boosting stock prices, or bearish, causing them to decrease.

- Ultimately, your investment strategy depends on your personal risk tolerance. However, it’s often wise to buy low and sell high during a bull market and be cautious about investing in a bear market, as the risk level is much higher.

Whether you’re an experienced investor or are just getting started, understanding a bull vs. bear market can be valuable information when making financial decisions. For more information on investing, check out these guides outlining how to invest in stocks and how to avoid common investing mistakes.

Sign up for MintThe post Bull vs. Bear Market: What’s the Difference? A Beginner’s Guide appeared first on MintLife Blog.

from MintLife Blog https://ift.tt/Hr3se2m

Comments

Post a Comment

We will appreciate it, if you leave a comment.