In this TurboTax Review you’ll see that it is one of the most popular tax preparation software programs out there, and for very good reason.

In this TurboTax Review you’ll see that it is one of the most popular tax preparation software programs out there, and for very good reason.

It offers a step-by-step process for preparing your taxes so you can rest assured that every I is dotted, every T is crossed, and every eligible deduction is taken.

They take care of yearly tax updates, making sure that their customers comply with the confusing and constantly changing tax code.

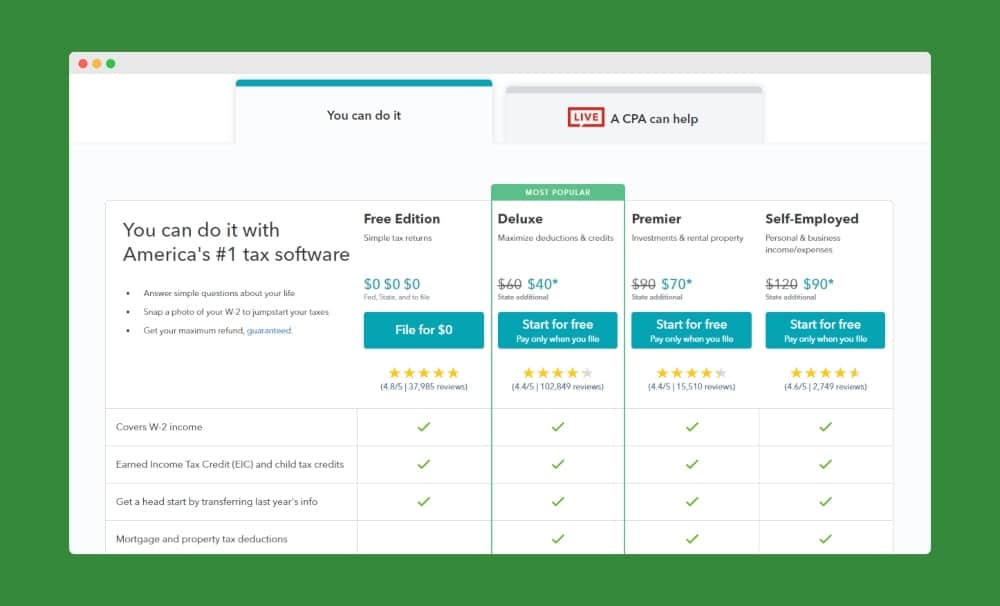

TurboTax is a popular tax prep software that will allow you to quickly and easily file your return from home. Besides the free version, it offers three do-it-yourself versions, ranging between $40 and $90. If you want expert help you can choose one of their three “Live” versions which range in price from $90 to $170.

How TurboTax Works

TurboTax is a product of Intuit, the same company that owns Mint.com and QuickBooks. They provide their software in both offline versions (CD or download) and in the increasingly popular online versions. I have used TurboTax in the past and I enjoy their product. Their excellent user interface can actually make the tax filing process even a little bit enjoyable.

Assurance of Accuracy

Their software is perfect for the person who feels fairly confident in preparing their tax forms, but who might need a little extra assurance of accuracy. TurboTax has always checked your returns for errors.

This delivers a comprehensive and streamlined review of your return, checking for any missing, incomplete, or conflicting information. The program then guides you through correcting those errors before filing.

Filing Quickly and Easily

Filing your tax returns with TurboTax is simple and painless, thanks to the auto-fill feature. All you need to do is snap a photo of your W-2, verify your data, and your information will automatically populate the appropriate section of your tax forms.

The TurboTax mobile app allows you to access the full suite of TurboTax products anytime and anywhere. The mobile app offers a virtual assistant help system that allows you to easily view and search the FAQ section, as well as ask questions using a text-like program within the app.

These questions are answered 24/7. Finally, Apple Pay customers can pay for their TurboTax prep with a touch of the fingertip on iOS.

TurboTax can help you track your refund once you’ve officially filed your return. The IRS estimates it takes about 21 days from the time of submission to when most filers receive a tax refund.

In the case of a delay in processing your return, you may want to check the “Where’s My Refund” section on TurboTax’s website for information. They provide several resources listing common reasons for delayed tax refunds.

Customer Support with TurboTax Live

It used to be that tax filers who required face-to-face time with a professional (as many taxpayers do) were out of luck with TurboTax since it had no physical branches where you could actually meet with a tax professional. But TurboTax created an ingenious fix to this problem by introducing TurboTax Live.

This program offers you the ability to connect to a live Certified Public Account (CPA), Enrolled Agent (EA), or Practicing Attorney for personalized tax advice and answers, as well as a one-on-one review of your return. They can even sign and file for you. The live help option is also available in Spanish.

You can be confident using TurboTax Live because they search over 350 tax deductions to ensure you’ll receive the best possible refund, guaranteed. TurboTax guarantees correct returns as well, and they’ll pay any IRS penalties should they happen to mess anything up. Of course, you’ll want to double-check that the information you enter is correct. TurboTax has no way of knowing if you transposed a few digits.

TurboTax Live also backs its services with an Audit Support Guarantee. This means in the event that you do get audited, TurboTax will provide ongoing assistance throughout the stressful auditing process.

My Review of TurboTax Live Support

I hit a snag when trying to figure out the medical savings account information through my wife’s work. We had not yet exhausted our annual savings in that account (which is a “use-it-or-lose-it” medical savings account) and I couldn’t figure out if we still had time to spend what is left in there, or if we’re already out of luck.

I clicked the “Expert Help” button for live help, and within a couple of minutes, a friendly tax professional named Colleen called me and set up a one-way video. She helped me figure out that we needed to get the proper 1099-SA form from my wife’s employer to be able to complete our taxes.

She also let me know that we had until tax day to deplete our annual medical savings account.

Colleen did not have this information at her fingertips and had to do a little research to find it. Honestly, that made me feel a little better about my confusion. It was abundantly clear that the tax pros at TurboTax Live will go the extra mile to get the right answer even if you have an uncommon question.

Find the TurboTax Product That’s Right for You

You can have access to TurboTax Live at every product level. That means there are now eight potential product tiers you can choose from. You may be wondering which TurboTax product is right for you.

First, let’s review the DIY versions.

TurboTax Federal Free Edition (Free)

Taxpayers who file a 1040EZ, 1040A, or a simple 1040 may qualify for TurboTax’s free edition of their software, regardless of income. This version is very straightforward: it asks you a series of questions, checks for any errors, and then helps you e-file for free.

If you have to itemize your return because you have a mortgage, child care expenses, charitable donations, or medical expenses, then you should not use this edition. This version comes with the same guarantees as the other paid versions. Filers using the free edition do not have access to live support.

However, there is an expanded set of self-help tools available if you encounter an issue of which you are unsure.

In addition, the state version of this edition is also completely free, meaning taxpayers with simpler financial situations can file all of their taxes for $0.

Get started with TurboTax Federal Free Edition.

TurboTax Deluxe ($40)

This is the most popular TurboTax software that the company offers. It is aimed at the average taxpayer without investments, rental property, or self-employment income. This version will help you complete your itemized deductions and find available credits.

TurboTax Deluxe comes with ItsDeductible . This feature helps you determine the deduction value of donated clothes, household items, and other charitable donations. It also includes the Audit Risk Meter

. This feature helps you determine the deduction value of donated clothes, household items, and other charitable donations. It also includes the Audit Risk Meter , which gives you a visual indication of your possible audit risk. And finally, it has the Audit Support Center. This entitles you to one-on-one guidance from a tax pro about what to expect and how to prepare in the event that you are audited.

, which gives you a visual indication of your possible audit risk. And finally, it has the Audit Support Center. This entitles you to one-on-one guidance from a tax pro about what to expect and how to prepare in the event that you are audited.

The Deluxe CD/Download product is available for $69.99, and the online version is $40. You can add state filing to this edition for $40.

Get started with TurboTax Deluxe.

TurboTax Premier ($70)

The Premier edition offers you everything you get with the Deluxe software, plus support related to investments and/or rental properties.

With the premier edition, you are able to quickly import your investment data from various institutions. Taxpayers who are also landlords will find that this program helps you to quickly find deductions associated with your rental units.

The CD or Download version of TurboTax Premier costs $99.99, with the online version at $70. You can add state filing to the Premier edition for $40.

Get started with TurboTax Live Premier.

TurboTax Self-Employed ($90)

This edition–which was previously called the Home & Business edition–is retooled to be even more helpful for self-employed taxpayers. The program provides entrepreneurs, freelancers, and side hustlers with year-round service through QuickBooks Self-Employed.

Here’s how it works: you can link your bank accounts and credit cards to QuickBooks, and the ExpenseFinder feature will scan and categorize your spending to find deductible business expenses that you might otherwise forget about.

feature will scan and categorize your spending to find deductible business expenses that you might otherwise forget about.

The Home and Business Edition is still available in CD/Download versions, which will cost you $109.99. The online version for the self-employed is $90.

You can add state filing to this edition for $40.

Get started with TurboTax Self-Employed.

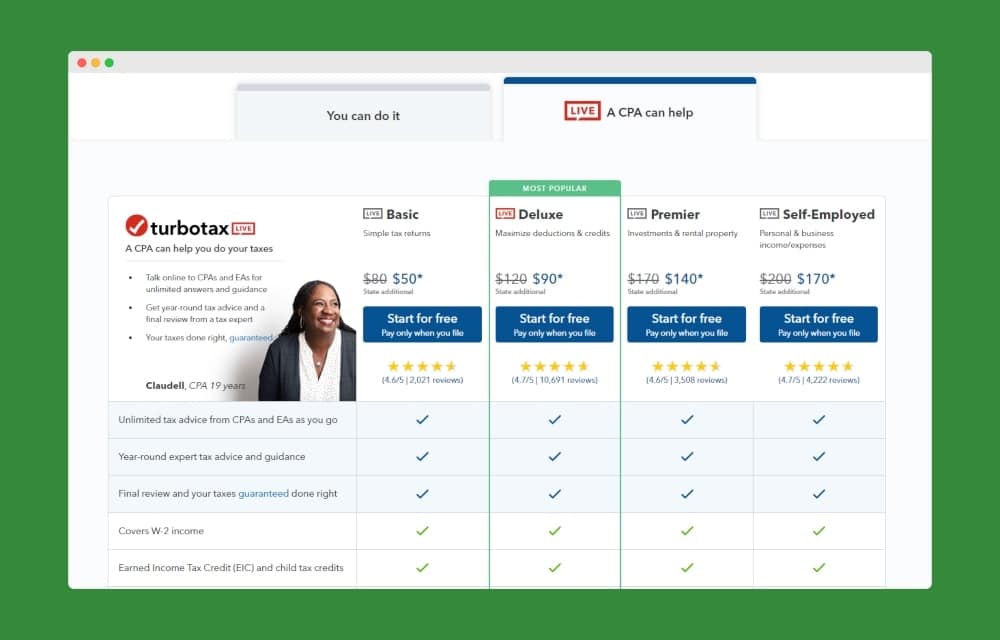

TurboTax Live

Next, let’s take a look at the TurboTax Live editions. Each of these versions is similar to its counterpart above but also gives you access to a CPA for unlimited assistance.

TurboTax Live Basic ($50)

Like the Federal Free Edition, the TurboTax Live Basic edition is intended to help those with simple tax situations navigate their filing. But this edition offers you live, onscreen, on-demand help from a tax professional, and all advice from the professional is guaranteed. You also have access to unlimited year-round tax advice, on-demand.

You can add state filing to this edition for $40.

Get started with TurboTax Live Basic.

TurboTax Live Deluxe ($90)

TurboTax Live Deluxe adds live, onscreen, on-demand help from a tax professional to the most popular TurboTax software. For any taxpayer who wants to make sure they claim all available deductions and credits, with the guarantee of a CPA or EA’s expertise, the TurboTax Live Deluxe option is an excellent choice.

The Live Deluxe version of TurboTax helps taxpayers to check all of the appropriate boxes regarding mortgage and property tax deductions, charitable donations, and student loan interest deductions. Of course, it includes all of the features of the Live Basic version as well.

You can add state filing to this edition for $40.

Get started with TurboTax Live Deluxe.

TurboTax Live Premier ($140)

The Live Premier edition takes the Deluxe edition a few steps further by giving you the support you need for your investments or rental properties. Since real estate and other investments can definitely complicate your overall tax picture, this support is a huge benefit. It will give you the peace of mind that comes with a tax professional’s guaranteed advice.

You can add state filing to this edition for $40.

Get started with TurboTax Live Premier.

TurboTax Live Self-Employed ($170)

The self-employed who may feel overwhelmed by their tax situation can turn to the TurboTax Live Self-Employed edition for help. It includes all the tools available in the regular Self-Employed edition, plus a live tax professional. This will help answer those difficult-to-pin-down self-employment tax questions. (Can I deduct my utilities if I work from home? Are all meals at a professional conference deductible?)

A couple of new features have been added recently that will really be useful to freelancers and the self-employed. One is the easy importing of your 1099-MISC form. The second feature is that you get access to your Year-Round Tax Estimator after filing your taxes.

For someone who is self-employed, these two new perks will be really beneficial.

You can add state filing to this edition for $40.

Get started with TurboTax Live Self-Employed.

Special Circumstances

Military folks, including all active military and reservists, can file their taxes for free with the TurboTax Online products. This includes both state and federal taxes and is valid for the Free Edition, Deluxe, Premium, and Self-Employed.

However, this benefit does not extend to TurboTax Live versions or to the TurboTax CD/Download products.

TurboTax General Customer Support

Should you require assistance at some point, TurboTax does have a couple of phone numbers you can call.

- 800-446-8848 (most common number listed for customer service)

- 888-777-3066 (toll-free number)

If you’re hoping to experience the shortest possible wait time (and who isn’t?), then it’s advisable to call first thing in the morning. The hours for service are 8 a.m.-5 p.m. PST.

Can I Downgrade My TurboTax?

If you’re concerned about choosing a higher level of TurboTax products than you actually need, here’s what to do. Go ahead and input your data for the level you think you need, and see what your anticipated refund or amount owed would be.

Now, you’ll want to decide for certain whether to go ahead and file at the level you used. You can only downgrade or move to a lower-cost level of TurboTax if you haven’t yet submitted your tax return. So if you’re considering moving down a level, think twice before you select the option to file your return.

If you decide you want to downgrade, perhaps from TurboTax Premier to TurboTax Deluxe, then just select the “clear and start over” option on the page. Again, you can only do this if you haven’t submitted the return yet.

TurboTax Guarantees

TurboTax didn’t become the leader in tax software by accident. They put together a good, solid product and they stand behind it. They make a commitment to their customers to not only be easy-to-use and 100% accurate, but to also provide the maximum refund.

All of their versions come with a money-back guarantee. All of their online versions are free to use up until the point that you actually file. So there’s no harm in giving them a spin if only to see what kind of refund you’ll be ending up with this year.

Turbotax is America's #1 tax software. Answer simple, non-taxy questions. Start for free.

Comments

Post a Comment

We will appreciate it, if you leave a comment.