If you don’t know the drill yourself, you’ve probably seen a loved one experience it: Weeks after a medical procedure, you’re blindsided with a bill much higher than anything you were anticipating.

Sometimes this is due to a procedure not being covered by your insurance plan, and other times it’s because your medical provider is out of network. Whatever the reason, it is a terrible feeling to be hit with a bill you can’t afford.

Thankfully, there are strategies that can be implemented that remove the uncertainty surrounding your treatment. This is especially important for the 28 million people in the United States who do not have health insurance. Regardless of your health care coverage, you can take control of the situation by learning how to negotiate medical bills.

1. Negotiate Ahead of Your Procedures

Medical emergencies are bound to arise, which can take planning for medical bills out of the equation. Planned procedures, however, provide a unique opportunity to negotiate with health care providers before you go into their office — keeping you out from under their thumb. Oftentimes, these planned appointments reduce the need for some emergency visits altogether.

Similar to dealing with car dealers, there is no shame in shopping around for a doctor with the lowest rate. In this situation, being upfront is best. Tell the doctor the treatment you need and what competing doctors in the area are charging. If there’s wiggle room in their price, now is the best time to find it. Keep in mind, however, that the proven skill of an experienced doctor may be worth the comparatively higher cost of their services.

Questions that may be useful when negotiating hospital bills or medical bills ahead of your procedure include:

- Can any fees be waived if I agree to pay now?

- Are there any financial hardship discounts?

- What is the best price offered to insurers?

2. Check Your Itemized Bill for Errors

Yes, medical bills can contain errors. In fact, some watchdogs claim over 90 percent of bills contain errors. As unfortunate as this is to discover, it does provide the opportunity to lower your charges even after receiving emergency treatment. Those dealing with high insurance deductibles stand to gain even more.

Before you begin to fact-check your bill, ensure you are referencing the correct statement. Your insurance company will provide you with an Explanation of Benefits, but this is subject to change while your claim is being processed. Consider avoiding paying until after you have requested and received your itemized bill from your provider.

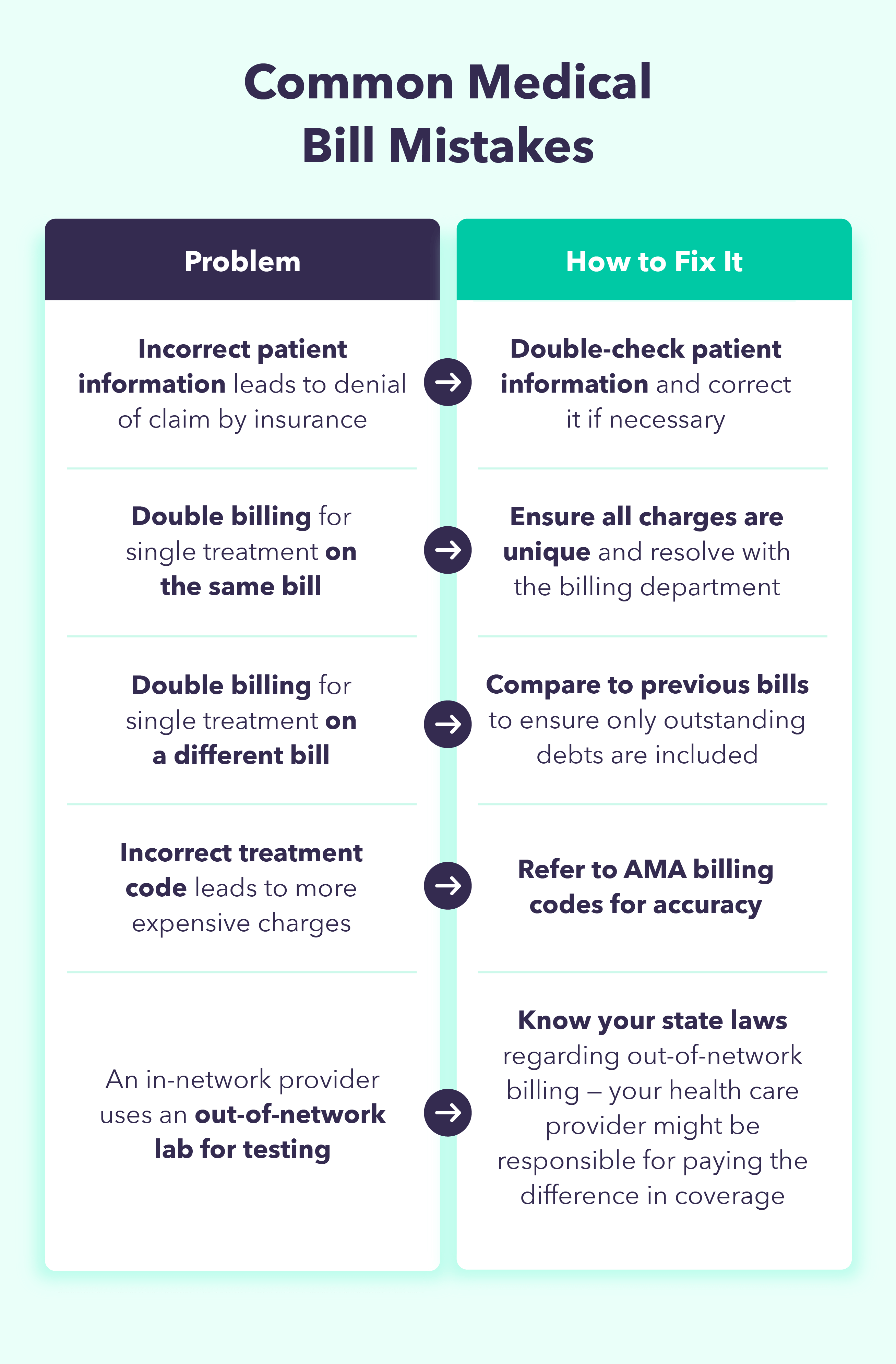

Your itemized bill is the best source to determine if inaccuracies are increasing what’s owed. Common mistakes found on medical bills include:

- Incorrect patient information: This can lead to denial of a claim by insurance.

- Double billing for a single treatment: Sometimes the treatment can appear twice on the same bill. Other times a treatment that was already paid for reappears later.

- Incorrect treatment code: This can lead to more expensive charges. The American Medical Association (AMA) website can be used to verify these codes.

- An in-network provider mistakenly uses an out-of-network lab for testing: Many states have protections for patients in this scenario, preventing them from unnecessarily paying for out-of-network tests.

Reconcile this itemized bill with your medical and insurance providers to guarantee you are only paying for what your plan requires. If you’re already paying a premium for your insurance policy, you might as well take full advantage.

3. Ask for a Reduction

Many people are in the habit of thinking of a bill as nonnegotiable. Regarding a retail purchase, that is true — a salesclerk doesn’t have the time or the interest in haggling over the price of a blouse. A medical bill is a different story.

Even insurance companies negotiate with medical providers about the price they are willing to pay for their services. This discounted price is available to you, too, especially those who are uninsured. The secret is that you have to know to ask for it.

This strategy can be used by people with no insurance to get the same reduced rate. It can also be used by people who received treatment that wasn’t covered by their existing policy.

Ask your billing department for the negotiated rate that is offered to insurance companies. The bill you received is likely to be much higher than this rate because the hospital was already anticipating an insurance carrier reducing it.

4. Check if You Qualify for Aid

Medical bills are likely among the highest personal bills the average individual will come across in their life. Hospital costs throughout the U.S. averaged $2,607 a day in 2020. That’s why so many organizations exist with the sole intention of helping others pay off these debts. Not pursuing one of these sources is akin to leaving money on the table that was intentionally left there for you.

Medicaid

The federal government set up the Medicaid insurance program specifically to help low-income Americans struggling with medical bills. In most states, this emergency coverage can cover your original charges even if you did not have an active policy, so long as you were eligible at the time. Specifics for coverage and timelines vary greatly from state to state — be sure to check your state’s specific program to see if you are eligible.

Local Agencies

Looking within your community is another great place to find assistance. There are many grant programs set up at the state, county, and town levels that are specifically targeted to tackle medical emergencies. Even if they do not cover the full price of a treatment, they can help delay the time it takes before your bill gets sent to collections. This could give you enough time to get the remaining funds yourself and avoid collections altogether.

Charities

Where the government falls short, look to private charities to pick up the slack. If you’re dealing with a specific condition, there may be a foundation already in place to help you. Charitable assistance can target bills related to treatment, like chemotherapy, or to needed medical devices, like wheelchairs and hearing aids. Check out directories like the Patient Advocate Foundation for comprehensive lists.

Charity Care

Sometimes assistance can be found through your hospital. Often called charity care, this department actively wants you to find sources of aid. Remember, hospitals are less concerned with where you get the money from than whether or not you are making payments.

The effectiveness of these programs will depend on the organization they are associated with. Some will have robust resources while others are little more than skin and bones. A competent program will be able to coordinate with billing agencies and readjust the amounts on bills you already owe.

5. Negotiate a Payment Plan

Health care providers want to be paid. They do not want to send bills to collections or force patients into bankruptcy. By showing your intention to pay, they will be much more likely to offer you a reasonable payment plan.

These plans have no interest rates and are adjusted to a price you can afford on your current income level. It’s important to be upfront about what you can realistically pay every month. Your present income is relevant, but so is your overall financial burden. The more evidence you have backing up what you can afford to pay, the better.

If you start missing the agreed-upon payments, the billing department may lose patience and send you to collections. This would further complicate your life and could even lead to lawsuits down the road. It’s best to avoid this altogether by negotiating a reasonable amount.

6. Find Discounts on Prescriptions

The cost of filling recurring drug prescriptions can quickly surpass the original cost of treatment. There are multiple avenues available to find discounts on this necessary medicine. The most common is to look for a generic version of the name-brand option. But not all prescription drugs have a generic option, and not all patients can take the risk of switching from the name brand. In those cases, there are charitable options as well.

Many drug manufacturers have charity care programs in place specifically for people who cannot afford the cost of their prescriptions. Visit the manufacturer’s website to see the qualifications and be connected with assistance programs, or contact the manufacturer directly to access their application.

Look for co-pay cards that can drastically reduce your out-of-pocket expenses. Many people save up to 80 percent of their bill, while some pay nothing. Your doctor or pharmacist should be able to recommend trustworthy sources for your needs.

A final option is to order your prescription drugs online from international pharmacies. So long as it is a verified source for the drug, this is a safe and legal means for acquiring your prescription at a reduced cost.

7. Don’t Ignore Your Bill

Most people are familiar with the anxiety that sets in when looking at a steep bill. It may be tempting to stick it back in the envelope and forget about it, but you need to fight that urge. The amount you owe is not going to disappear until after you do something about it.

If you delay paying, then you are likely going to hurt your credit score along with having to deal with debt collectors who are a lot less reasonable than your hospital’s billing department. Being proactive regarding your situation will be the single greatest step you can take toward improving it.

How to Pay Medical Bills

Medical providers can be quite flexible when it comes to how they receive payment for their services. But simply because you have the option to pay in any given method does not mean it’s always in your best interest to do so. Some of the benefits and weaknesses are explained below.

Cash

Cash is the favored means of payment to most proprietors, and the medical field is no different. By offering to pay your obligation immediately and in cash, any person regardless of insurance coverage will be able to greatly reduce their overall bill.

Be sure to keep your monthly budget in mind. Maybe you do have enough cash on hand to pay your bill immediately, but if that jeopardizes your ability to make other payments in the near future, you may want to avoid it. It may be best to enter a payment plan even if that means paying a slightly larger amount overall.

Credit Card

Due to the fees associated with making charges to credit cards, it’s unlikely for patients to be offered the same type of discounts as with cash. Credit cards also have the added risk of high interest rates for any missed payments. In most cases, it is advantageous for patients to avoid this option and work out a zero-interest payment plan with their health care provider.

If you are responsible enough to make your payments on time and enjoy the simplicity of using your credit card, this may be a worthwhile option. Plus, you may be able to earn rewards points.

Health Savings Account or Flexible Spending Account

Paying for health care costs is what health savings accounts and flexible spending accounts were expressly designed to do. They are tax-advantaged funds, acting very similarly to a bank account, where you can set aside money in the event you have any medical-related bills to pay.

A health savings account is usually offered through your insurance provider and it has no deadline, while a flexible spending account is offered by your employer and often must be spent by the end of the year.

Not everyone has the option to use one of these accounts. Those who do have access must make sure they fund the account before they need to make use of it.

Payment Plan

Those who do not have the funds on hand to pay their bill may find it beneficial to pursue a payment plan. This can be worked out directly with your health care provider’s billing department.

You’ll need to explain to them the amount you can reliably afford to pay every month. Take into account your current income and other expenses. If you misjudge how much you can afford to pay and end up missing payments, they may not be as cooperative with your needs in the future.

Unlike dealing with creditors, there will be no interest tacked onto your bill and your credit score will be unaffected. After that, you simply need to follow through on your commitment.

Personal Loans

A personal loan can be a great source of much-needed funds when you’re in a pinch. As with using a credit card, it’s important to understand all the consequences.

Interest rates associated with your loan can vary greatly depending on your credit score. Those with a credit score under 600 may find their interest rates to be unmanageable. Those with credit scores above 700 may be able to take advantage of a comparatively lower rate even when they have no collateral.

This probably will not be anybody’s first option when looking to pay their bills. Only after exhausting the previously listed options should a personal loan be pursued. If it can prevent your debt from going to collections, it can still be considered a viable option.

Bankruptcy

The final option for people overwhelmed by their medical debt is filing for bankruptcy. Be aware, however, that the repercussions following bankruptcy can last for many years and affect more than just your medical debts.

One of the advantages of filing for bankruptcy is that it puts an immediate pause on your creditors’ pursuit until it has been resolved. This can bring immediate relief to those dealing with multiple creditors vying for repayment.

On the other hand, there are no guarantees regarding your assets when filing bankruptcy. Your intention may be to liquidate your debts, but in the process, you may be liquidating your assets along with them.

Some people with medical debts utilize bankruptcy to get a fresh start. With strategic execution, they can be in a better financial position than when they started.

Bottom Line: Don’t Be Afraid to Ask For Help

Many people find it intimidating to talk about their finances. If you’re having a hard time wrapping your head around how to negotiate medical bills, you should consider reaching out to a financial expert. Using a financial app like Mint can help simplify the complicated world of money management. Many people have been in your exact position before and they found a way out. You can, too.

Sources: Census | Medliminal | Healthcare Insider | Patient Advocate Foundation| Debt.org

Comments

Post a Comment

We will appreciate it, if you leave a comment.