Even if you’re aware of the benefits, opening your first credit card can be intimidating. From navigating what spending means for your credit score to understanding how interest rates work — if you’re considering applying for a credit card, it’s important to understand how credit cards work to avoid unnecessary charges or even debt.

But how do credit cards work? In this beginners guide, we’ll make sure you’re ready to own your first credit card so you can capitalize on their benefits without putting a strain on your finances.

What Is a Credit Card?

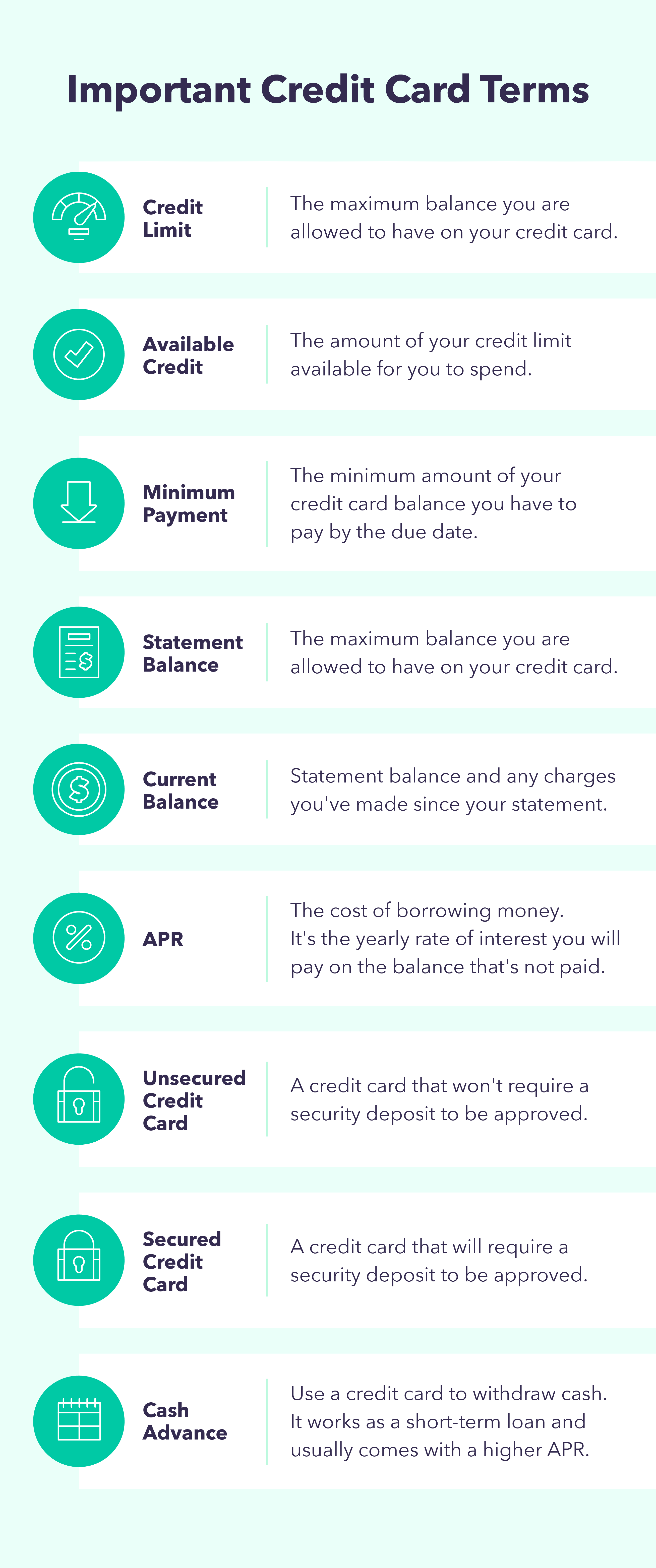

A credit card is a small plastic card used to purchase goods and services. They essentially work as a short-term loan where the bank will provide you a credit limit, which is the amount of money you’re allowed to spend. Once you start using your credit card for purchases, your available credit starts to decrease.

How Do Credit Cards Work?

When you use a credit card, you’re essentially borrowing money from your bank or the credit issuer. Once you purchase something and the payment is accepted, the amount is taken from your credit limit and included in your current balance.

Once a month, you’re encouraged to make the minimum payment for the card or pay the full statement amount. Keep in mind that not making the payments may come with a cost since any outstanding balance is subject to interest fees, which are caused by the annual percentage rate (APR).

APR is how much the credit issuer charges you to borrow a line of credit. It is charged on any outstanding balance after the credit card’s payment due date. To avoid paying interest charges, you need to pay off the full statement balance every due date. According to U.S. News, the average APR on all cards is 15.56 percent to 22.87 percent.

Here’s a breakdown of how APR works:

- Let’s say your new credit card has an APR of 18%

- Your credit card balance is $1,500

- If you keep this balance, you would end up paying interest fees. After one year, this amount would increase by $270 — 18% of $1,500. The interest amount is then added to your balance, totaling $1,770.

- If you decide to pay the full balance of $1,500 by the due date, you won’t have to pay the interest amount of $270.

After you make a payment, your available balance will increase by the amount you paid, allowing you to make more purchases.

Difference Between Credit Card and Debit Card

Although similar in appearance, credit cards and debit cards are different. A debit card automatically deducts money from your checking account. When you make a purchase using a credit card, you’re not using your own money at that moment.

Purchasing something with a credit card means you’re spending the credit issuer’s money, which you have to pay at a later date and is subject to interest fees.

| Credit Card | Debit Card |

|---|---|

| Offers a line of credit | Takes off money directly from account |

| Make a least the minimum payment | No minimum payment required |

| Subject to interest fees | No interest charged |

| Subject to late fees and annual fees | Subject to overdraft fees |

| Used to improve credit score | Does not affect credit score |

The good thing about debit cards is that you don’t have to worry about interest fees or minimum payments, and you likely won’t have to worry about late and annual fees, unlike credit cards. However, you could be subject to overdraft fees if there aren’t enough funds in your account to cover your purchase.

Additionally, credit cards can help you improve your credit score, whereas debit cards don’t affect your credit score.

The Benefits of Credit Cards

But do you need a credit card? If credit cards are used responsibly, they can provide you with many benefits. Here are some reasons why you should consider a credit card:

Build Credit

Having a good credit score can be helpful when purchasing a house or applying for a loan. By paying your credit card off on time and having a good credit utilization ratio, you can potentially increase your credit score — or start building one.

Convenience

Credit cards are a convenient and fast way to pay for goods and services. With contactless technology such as tap to pay and digital wallets, you don’t have to worry about searching for loose cash in your bag. They are also convenient since using credit you’re essentially paying it later.

Budgeting Tools

Credit card monthly statements can be a useful budgeting tool. Your credit card statement can help you figure out how much you’re spending on things and your spending habits.

Fraud Protection

Many credit cards have fraud protection and security features to keep you safe from credit card fraud. Although these protections vary by issuer, they can include different features like security alerts, fraud liability, and card locking options.

Rewards

Different credit cards will provide you with different rewards. Find a card that can provide you with the best rewards for your lifestyle. Credit card rewards can include cashback and travel miles.

Types of Credit Cards + How They Compare

Finding a credit card that’s right for you can help you better manage your money and build your credit score.

If you want to compare credit cards side by side, here’s what you should consider:

- What are the annual fees

- Do they have a free credit score checker

- Is there is a minimum deposit

- Which rewards are available

Here are some of the different types of credit cards:

Travel Rewards Credit Cards

If you travel often — or would like to travel more — consider a travel rewards credit card. With this card, you can earn points towards travel-related purchases, such as flights and hotels. Keep in mind that some cards have ties to specific airlines or hotels where you can only redeem your rewards through them.

Cash Back Credit Cards

With cash back credit cards you can earn cash rewards on everyday purchases, such as groceries, gas, and online shopping. Some cards will offer a bigger percentage of rewards for different categories, so it’s helpful to pick one that provides the biggest rewards for what you most commonly spend on.

Student Credit Cards

Student credit cards are usually easier to qualify for since they are geared towards college students. These cards will help students build their credit if used responsibly, and can also provide rewards relevant to students.

Secured Credit Cards

Secured credit cards are useful if you just started building your credit, have a bad credit score, or do not yet qualify for certain cards.

When you sign up for a secured credit card, you will put down a security deposit as collateral. You will be able to use the card as you normally would, and earn the deposit back by making your payments in time.

Secured credit cards are different from unsecured credit cards, which will look at your income and credit history, and won’t need collateral.

How To Build Credit + Use a Credit Card Wisely

Once you’re approved for the right credit card for you and know how credit cards work, it’s necessary to use your credit card wisely to build a good credit score. Here is how to build credit:

Pay Your Credit Card On Time

One of the most important things when building credit is to pay your credit card on time. That’s because the most significant factor that determines your credit score is your payment history.

The best way to pay your credit card on time is to set up automatic payments or set reminders.

Aim For a Low Balance

If your credit card balance is too high, it will negatively affect your credit score. To keep your credit card balance low, try to spend less than 30 percent of your credit limit each month. Also plan to only spend what you can afford to pay back.

Keep the Account Open

Your account age also have an effect on your credit score. For that reason, keep your older credit card accounts open to help build your credit score.

Request a Credit Limit Increase

If you want to aim for a low balance, having a higher credit limit can help you keep your balances below the 30 percent that’s recommended. You can usually request a credit limit increase after a year of having a credit card.

Watch Your Credit Score

It’s important to keep track of your credit score to understand how you can improve it. Usually, the FICO, the Fair Isaac Co., score is the most used by lenders, so make sure to check it every couple of months.

The Bottom Line

Owning a credit card is a great way to start building a good credit score if used responsibly. Now that you have an understanding of how credit cards work and their benefits, it's time to decide what credit card is best for you and start budgeting wisely.

FAQs about Credit Cards

Understanding how credit cards work is not easy, here are some questions you might be asking yourself.

How Do Credit Cards Make Money?

For the most part, credit card issuers make money by charging interest on the statement balance. They can also make money by charging bank fees, such as late and annual fees

What Is APR?

APR, which means annual percentage rate, is essentially the cost of borrowing money. It is charged on any outstanding balance after the credit card's payment due date. The average APR for credit cards is 15.56% to 22.87%.

How Do Credit Card Payments Work?

After paying with a credit card, the authorized payment will be added to your current balance and your available credit will be reduced by that amount. Once the statement balance is ready, you will have the option to pay a minimum amount, the full statement amount, or a custom amount. After you pay off your balance, if there's any remaining balance in the statement, it will be subject to an interest fee charge.

How Does Credit Card Interest Work?

A credit card interest is applied to the remaining statement balance if it's not paid in full. It can be calculated using your credit card APR, and by finding the average daily rate and average daily balance. A step-by-step calculation can be found here.

Comments

Post a Comment

We will appreciate it, if you leave a comment.