Short selling is an advanced trading strategy investors use when they speculate whether the price of a stock is going down. How it works: Investors borrow a share and sell it, with the hopes of buying it back later at a lower price. It’s also a strategy making headlines in recent months.

If you’ve been keeping up with the stock market news, you might’ve heard about short sellers losing millions of dollars due to the soaring prices of stocks, such as AMC and GameStop Corp. Whether you’re an investor yourself or interested in learning about investing, you’re in the right place to discover just what is short selling, including how to short sell stocks as well as the risks and benefits of short selling

Short Selling Explained

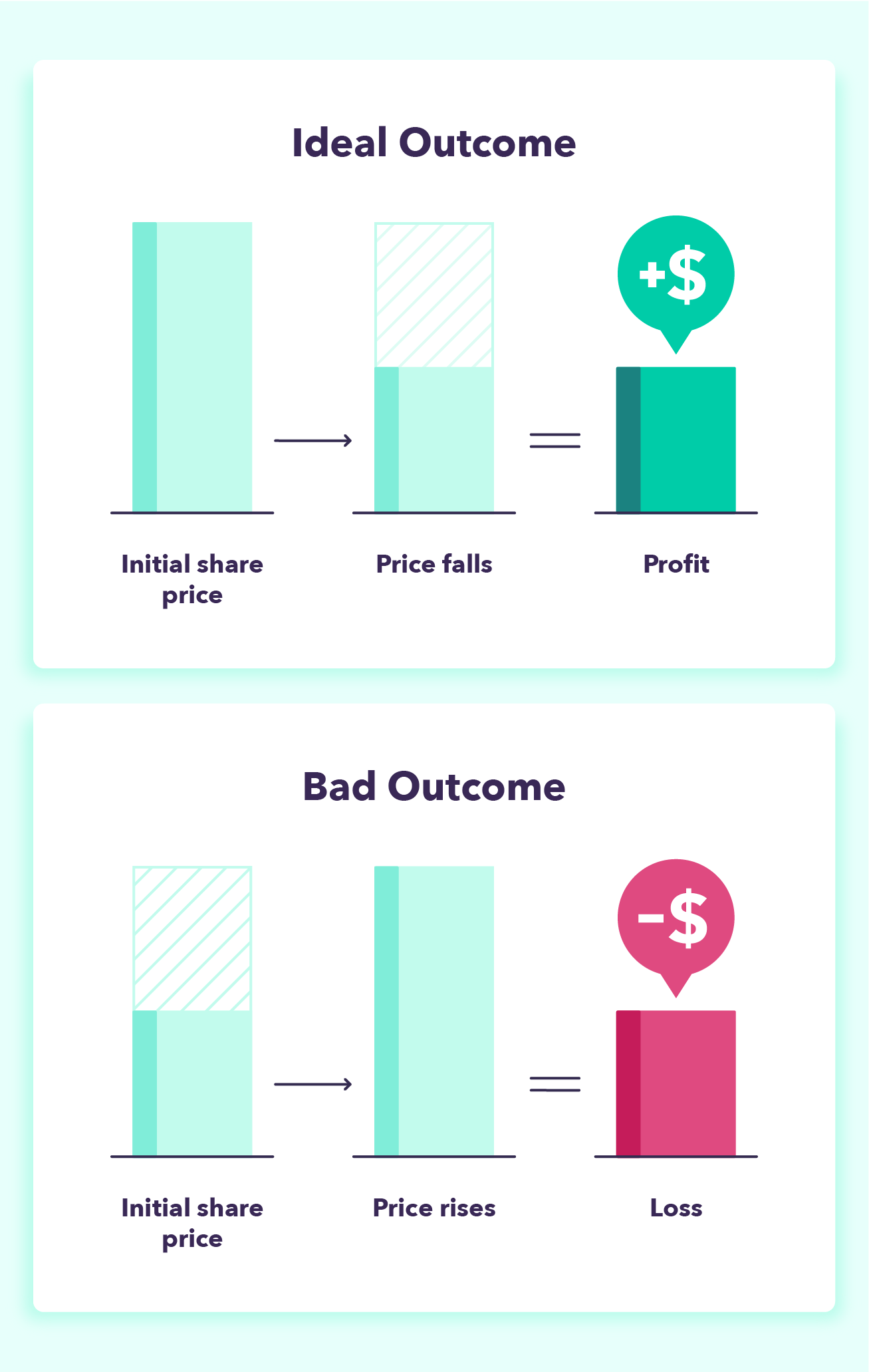

What does it mean to short a stock? Short selling stocks is an advanced trading strategy used either to hedge or speculate the anticipated decline in stock price. If the stock price goes down, it will result in a gain. If it goes up, it will result in a loss.

It’s essentially the opposite of long position investing. Long position investors own shares of stocks that they bought at a lower price and keep ownership of the stock expecting the prices to rise in order to make a profit when the stock is sold.

In contrast, short position investors borrow the shares from a broker and sell them at a higher price hoping the stock price will fall, so they can buy it back at the lower price and make a profit. However, shorting stocks theoretically has an unlimited risk of loss since there is no cap on the price of a stock.

In order to short the stock market, a trader must have a margin account, which is a type of brokerage account. In this arrangement, the broker lends cash to the investor to purchase stocks, which comes with an interest rate. The margin account also has a regulated minimum value, and if it falls below the maintenance margin, the investor is required to either add more funds to the account or sell their positions.

Why Short Sell Stocks?

Shorting stocks is common in the stock market, and is usually done by hedge funds and professional investors. Two of the main reasons for stocks being shorted are to speculate and to hedge.

The majority of investors who practice shorting will do so as a way to hedge risk of stock ownership, commonly referred to as long a stock. If the market goes down the short position will protect the long, and If the market goes up the long position will protect the short. For hedging to work, both long and short positions must be highly correlated.

And a speculator is an investor who embraces additional risk and resultant reward. A short selling example of this was in 1992, when George Soros risked a $10 billion short position in the British pound and made an estimated $1 billion on the trade in a matter of months.

How To Short a Stock

If you’re wondering how to short sell stocks, keep in mind that it can be a high-risk investment and should only be done by experienced investors and traders. Here is the process of shorting stocks explained in four steps:

- The first thing needed to start short selling stocks is to check the margin requirements on the stock.

- After meeting the margin requirements, the broker borrows the shares, which comes with an interest rate on the outstanding debt.

- Once the shares are borrowed, investors will then sell shares at the current market price, with the hopes that the price will go down.

- If the share prices go down, the investor will then buy those shares back at the lower price.

- Since the shares were borrowed, the short seller will then return those shares to the lender and keep the difference as a profit.

Pros and Cons of Short Selling Stocks

In the big picture, shorted stocks seem simple. However, there are some advantages and disadvantages:

| Pros of Short Selling | Cons of Short Selling |

|---|---|

| Possible high profit | Unlimited loss potential |

| Protection for long positions | Margin interest rate |

| Lower portfolio volatility | Dealing with margin |

| Potential for long squeeze | Potential for a short squeeze |

The possibility of high profit is one of the reasons traders decide to short the stock market, on top of being able to leverage their investment without needing to have the money upfront. Another reason to short sell is the possibility of protecting long position investments with little initial capital investment and lower portfolio volatility.

However, short selling stocks comes with significant risks. Since the price of a stock can increase indefinitely, there’s an unlimited loss potential and a chance that this will drive short sellers to buy back their positions, causing a possible short squeeze. Shorting stocks also requires the trader to have a margin account, which comes with interest rates and minimum equity.

More Shorted Stocks Considerations

Short selling stocks is a high-yield but also high-risk investment that requires trading experience. Therefore, there are some additional risks and costs associated with it.

Timing

Timing is essential to short a stock. Since stocks tend to decline faster than they advance, it can result in a big opportunity cost and capital loss. In addition, if the overvalued stock takes a long time to decline, investors are subject to an increased amount of time paying interest.

Margin Requirements

Broker margin requirements are complex, but necessary to protect market liquidity as a whole. Short sale margin begins with an initial margin of 150 percent of the stock sale price. Since 100 percent of sale proceeds can be applied to the margin, a remaining balance of 50 percent will be required to meet the initial margin.

Although stocks can also be used to meet the margin requirements, not all of them are, and the broker will be the one determining the margin value. After this initial margin, the short sale is also subject to margin maintenance rules.

With that said, an increase in the stock prices could lead to the account falling below the minimum, and result in a margin call. This would require additional cash or securities to be deposited. On the other hand, if the stock price decreases, funds can be withdrawn from the account or be reinvested.

Margin Interest

There are also some additional costs involved with shorting stocks. One of them is margin interest that can accrue if the short positions are kept open for an extended period of time. Brokers charge interest for the loan of stocks. Each broker will have a different rate for different loan amounts.

Depending on the size of the loan, current margin interest could be around 7 percent, and subject to interest rate increases and decreases.

Another common cost is if the investor decides to short a hard-to-borrow stock, which comes with a higher fee. Lastly, the short seller is also subject to making dividend payments on the shorted stock.

Stock Appreciation

Stocks have a tendency to appreciate over time, so short sellers are essentially going against the stock trend. Even if the stock is overvalued, because of inflation and other factors, the prices tend to go on an upward shift. This hurts the chances of short sellers buying the borrowed stock at a lower price for a profit.

Short Squeeze

A short squeeze happens when the prices of a stock begin to rise, and short sellers decide to buy back their positions to prevent a bigger loss. This causes a snowball effect in which the prices will spike, causing more short sellers to cover their positions and buy them back.

SEC Uptick Rule

The SEC has reestablished the alternative uptick (Rule 201), which is designed to restrict short selling of a stock that has dropped more than 10 percent in a single day. At that point, short selling would only be permitted if the price of the security is above the current national best bid.

Examples of Short Selling

It may be easier to understand shorted stocks with examples:

Short Selling Example: Profit

Stock ABC is currently trading for $10 and a trader believes its price will decrease. The trader would go to a brokerage and borrow 10 shares, which would cost $100. They immediately sell those shares and hope for the price to decrease.

One month later, the stock price falls to $5, and the trader decides to close the short position and buy back the 10 shares, which costs $50. Since they initially sold it for $100, the trader would then have made a $50 profit on this shorted stock, excluding any interest and commissions.

Short Selling Example: Loss

Let’s consider the same scenario in which the trader borrowed 10 shares of stock ABC at $10 and sold them for $100. But this time, the stock price soars to $30.

The trader decides to close their short position to prevent further losses in case the prices continue to increase. They would then buy 10 shares for the current price of $30, costing them $300. In this example, the trader would have lost $200, since they initially sold it for $100.

Conclusion

The Bottom Line

Learning how the stock market works can be a good way to understand potential investment opportunities. If, at the beginning of this, you were asking yourself, “What is short selling?” you should now have a fair understanding of how experienced traders take part in this trading strategy, as well as the risks and benefits associated with it.

FAQs About Short Selling

Here are some commonly asked questions traders may have when learning about short selling:

Why do short sellers have to borrow shares?

Short sellers have to borrow shares so the shares sold can be delivered to the purchaser of the shares on the other side of the short sale transaction in order to make a profit. Since you can’t sell a share that doesn’t exist, and companies have a limited amount of shares, the brokerage must borrow one that already exists.

Is short selling illegal?

Short selling is a legal form of trading and is regulated by the U.S. Securities and Exchange Commission. However, it’s illegal to partake in naked shorting, which is the practice of short selling stocks that are not determined to exist.

Is short selling considered bad?

Some traders believe short selling could result in an unstable securities market, and that short sellers know extra information that others don’t. Others see it as a useful practice that could potentially help companies operate more efficiently.

Can shorts be sold through an individual account?

Some brokerages will allow shorts to be sold in individual accounts as long as investors apply for a margin account.

Sources: Forbes

This post on TessMore Finance: What Is Short Selling? A Simplified Guide on How To Short a Stock was also published on MintLife Blog.

Comments

Post a Comment

We will appreciate it, if you leave a comment.