As a company selling products, you need to know the costs of creating those products. That’s where the cost of goods sold (COGS) formula comes in. Beyond calculating the costs to produce a good, the COGS formula can also unveil profits for an accounting period, if price changes are necessary, or whether you need to cut down on production costs.

Whether you fancy yourself as a business owner or a consumer or both, understanding how to calculate cost of goods sold can help you feel more informed about the products you’re purchasing — or producing.

What Is Cost of Goods Sold?

Cost of goods sold is the cost of producing the goods sold by a company. It includes the cost of materials and labor directly related to that good. However, it excludes indirect expenses such as distribution and sales force costs.

What Is the Cost of Goods Sold Formula?

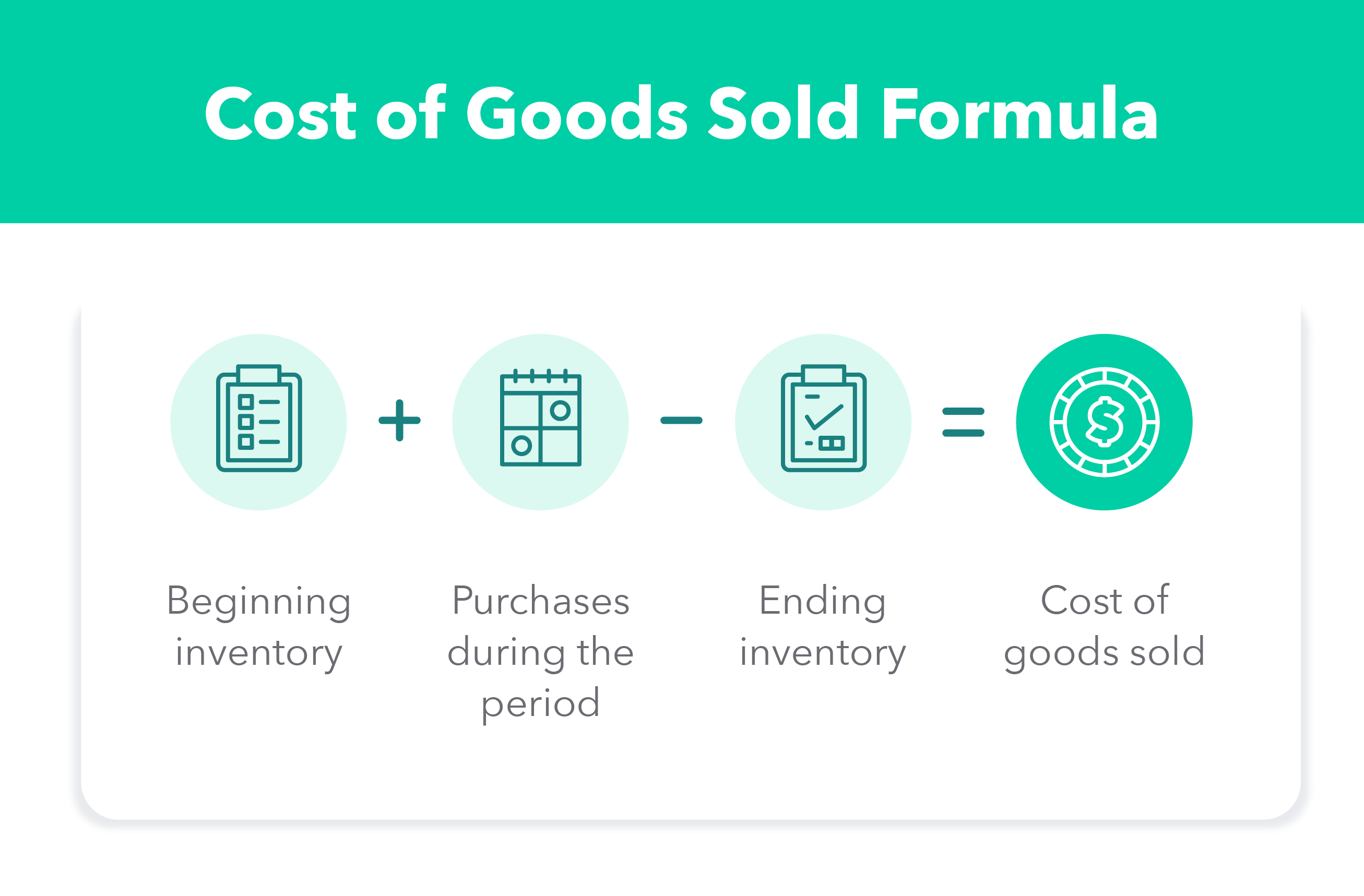

When selling a product, you need to understand the production costs associated with it in a given period, which could be a month, quarter, or year. You can do that by using the cost of goods sold formula. It’s a straightforward calculation that accounts for the beginning and ending inventory, and purchases during the accounting period. Here is a simple breakdown of the cost of goods sold formula:

| COGS = beginning inventory + purchases during the period – ending inventory |

How Do You Calculate Cost of Goods Sold?

To calculate cost of goods sold, you have to determine your beginning inventory — meaning your merchandise, including raw materials and supplies, for instance — at the beginning of your accounting period.

Then add in the new inventory purchased during that period and subtract the ending inventory — meaning the inventory leftover at the end for your accounting period. The extended COGS formula also accounts for returns, allowances, discounts, and freight charges, but we’re sticking to the basics in this explanation.

Taking it one step at a time can help you understand the COGS formula and find the true cost behind the goods being sold. Here is how you do it:

Step 1: Identify Direct and Indirect Costs

Whether you manufacture or resell products, the COGS formula allows you to deduct all of the costs associated with them. The first step is to differentiate the direct costs, which are included in the COGS calculation, from indirect costs, which are not.

Direct Costs

Direct costs are the costs tied to the production or purchase of a product. These costs can fluctuate depending on the production level. Here are some direct costs examples:

- Direct labor

- Direct materials

- Manufacturing supplies

- Fuel consumption

- Power consumption

- Production staff wages

Indirect Costs

Indirect costs go beyond costs tied to the production of a product. They include the costs involved in maintaining and running the company. There can be fixed indirect costs, such as rent, and fluctuating costs, such as electricity. Indirect costs are not included in the COGS calculation. Here are some examples:

- Utilities

- Marketing campaigns

- Office supplies

- Accounting and payroll services

- Insurance costs

- Employee benefits and perks

Step 2: Determine Beginning Inventory

Now it’s time to determine your beginning inventory. The beginning inventory will be the amount of inventory leftover from the previous time period, which could be a month, quarter, or year. Beginning inventory is your merchandise, including raw materials, supplies, and finished and unfinished products that were not sold in the previous period.

Keep in mind that your beginning inventory cost for that time period should be exactly the same as the ending inventory from the previous period.

Step 3: Tally Up Items Added to Your Inventory

After determining your beginning inventory, you also have to account for any inventory purchases throughout the period. It’s important to keep track of the cost of shipment and manufacturing for each product, which adds to the inventory costs during the period.

Step 4: Determine Ending Inventory

The ending inventory is the cost of merchandise leftover in the current period. It can be determined by taking a physical inventory of products or estimating that amount. The ending inventory costs can also be reduced if any inventory is damaged, obsolete, or worthless.

Step 5: Plug It Into the Cost of Goods Sold Equation

Now that you have all the information to calculate cost of goods sold, all there’s left to do is plug it into the COGS formula.

An Example of The Cost of Goods Sold Formula

Let’s say you want to calculate the cost of goods sold in a monthly period. After accounting for the direct costs, you find out that you have a beginning inventory amounting to $30,000.

Throughout the month, you purchase an additional $5,000 worth of inventory. Finally, after taking inventory of the products you have at the end of the month, you find that there’s $2,000 worth of ending inventory.

Using the cost of goods sold equation, you can plug those numbers in as such and discover your cost of goods sold is $33,000:

| COGS = beginning inventory + purchases during the period – ending inventory |

| COGS = $30,000 + $5,000 – $2,000 |

| COGS = $33,000 |

Accounting for Cost of Goods Sold

There are different accounting methods used to record the level of inventory during an accounting period. The accounting method chosen can influence the value of the cost of goods sold. The three main methods of accounting for the cost of goods sold are FIFO, LIFO, and the average cost method.

FIFO: First In, First Out

The first in, first out method, also known as FIFO, is when the earliest goods that were purchased are sold first. Since merchandise prices have a tendency of going up, by using the FIFO method, the company would be selling the least expensive item first. This translates into a lower COGS compared to the LIFO method. In this case, the net income will increase over time.

LIFO: Last In, First Out

The last in, first out method, also known as LIFO, is when the most recent goods added to the inventory are sold first. If there’s a rise in prices, a company using the LIFO method would be essentially selling the goods with the highest cost first. This leads to a higher COGS compared to the FIFO method. By using this method, the net income tends to decrease over time.

Average Cost Method

The average cost method is when a company uses the average price of all goods in stock to calculate the beginning and ending inventory costs. This means that there will be less of an impact in the COGS by higher costs when purchasing inventory.

Considerations for Cost of Goods Sold

When calculating cost of goods sold, there are a few other factors to consider.

COGS vs. Operating Expenses

Business owners are likely familiar with the term “operating expenses.” However, this shouldn’t be confused with the cost of goods sold. Although they are both company expenditures, operating expenses are not directly tied to the production of goods.

Operating expenses are indirect costs that keep a company up and running, and can include rent, equipment, insurance, salaries, marketing, and office supplies.

COGS and Inventory

The COGS calculation focuses on the inventory of your business. Inventory can be items purchased or made yourself, which is why manufacturing costs are only sometimes considered in the direct costs associated with your COGS.

Cost of Revenue vs. COGS

Another thing to consider when calculating COGS is that it’s not the same as cost of revenue. Cost of revenue takes into consideration some of the indirect costs associated with sales, such as marketing and distribution, while COGS does not take any indirect costs into consideration.

Exclusions From COGS Deduction

Since service companies do not have an inventory to sell and COGS accounts for the cost of inventory, they can’t use COGS because they don’t sell a product — they would instead calculate the cost of services. Examples of service companies are accounting firms, law offices, consultants, and real estate appraisers.

The Bottom Line

Running a business requires many moving parts. To ensure a company is making a profit and everyone’s paid a fair salary, business owners should have a well-rounded view of the costs associated with their goods sold.

Following this step-by-step guide to learn how to use the cost of goods sold formula is a good starting point. As always, it’s important to consult an expert, such as an accountant, when doing these calculations to make sure everything is accounted for.

Sources: QuickBooks

This post on TessMore Finance: Cost of Goods Sold Formula: A Step-by-Step Guide was also published on MintLife Blog.

MintLife Blog https://ift.tt/3r5Tvjn

Comments

Post a Comment

We will appreciate it, if you leave a comment.