I know, I know. You’ve been told you’re “throwing money away on rent.” Someone in your life made you feel guilty for not buying a house and building equity. And let me guess: They said something like, “Ugh, I just hated paying someone else’s rent!”

Right?

There’s just one problem: It’s not true.

First, let me ask you a simple question: Do you “throw money away” when you eat out at a restaurant? Of course not. You’re paying for value.

Yet somehow this logic totally falls apart when you apply it to real estate.

I decided to run a poll on Twitter to ask what people thought.

Not surprisingly, 95% of people said, “No, you didn’t ‘throw money away’ on a nice meal.”

Then I asked the same question — but for rent.

LOL! Notice the drop from 95% to 81% when I asked if I was ‘throwing money away renting.’” In other words, many more people believe that renting is throwing money away.

You and I know that if we spend $20 eating out, we were happy to spend it to get good food, table service, and someone who cleans up our dishes.

Paying for rent is exactly the same: You’re paying for a roof over your head (the meal). You’re also paying for a landlord to deal with any paperwork and maintenance issues (the service).

So why do so many of us blindly repeat this phrase that we’re “throwing money away on rent?”

Why do people believe that rent is a waste of money?

Understanding why this myth persists is the first step in understanding the truth about buying vs renting. Check out these reasons why many people believe that rent is a waste — what do you notice?

1. Propaganda

The powerful real estate lobby, the government, and our parents all tell us that “real estate is the best investment of all.” There are even governmental tax incentives to buy! Repeat this for decades and a population starts to blindly believe, rather than running the numbers.

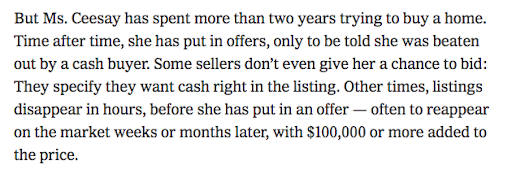

Here’s a tiny glimpse of how the real estate propaganda machine works. In this article from the New York Times, buying a house subtly portrayed as the ultimate, foolproof way to get rich in America. Fast. Hurry! Prices only go up! Add in HGTV, economic malaise, & phrases like “you’re throwing money away on rent.”

“Minus expenses.” LOL. Given that “expenses” can run over 10% of a house’s selling price, that’s like me saying, “I really enjoyed this trip to the Grand Canyon! All except for the part where my son fell off a cliff and died. Anyway, it was fun!”

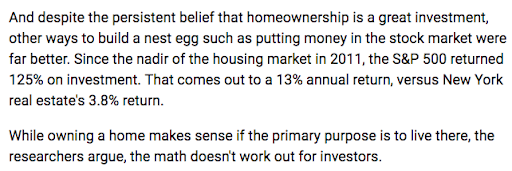

In reality, real estate is not always the best investment. It comes with significant phantom expenses. And there are often better investments, such as a simple low-cost index fund. This is well-understood by sophisticated investors but ordinary Americans have been duped into thinking their primary residence is a great investment. Often, it is not. (I could buy today but I rent by choice because it is a better option for me.)

2. Financialization of real estate

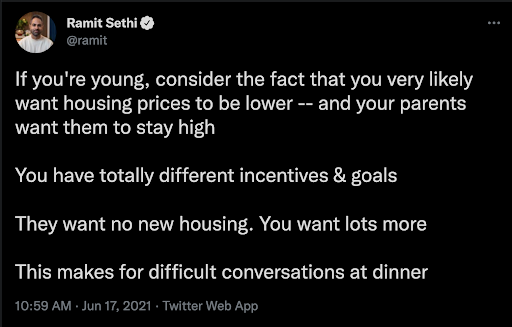

In America, we believe that our house should also be an investment. Why? It’s not like that in many other countries. In fact, if you sit down at the dinner table with your parents, they want the price of their house to stay high — while younger people want the price of housing to go down!

3. The idea that someone’s “getting one over on you”

Americans HATE the idea that someone is making money off them. A Reddit comment said (paraphrased) “If you buy, it might cost more but at least you won’t be paying your landlord’s rent.” Do you understand how crazy this is? When you eat out, do you say, “I like the food here but I just hate paying this restaurateur’s rent?” Of course not. We only repeat this phrase with real estate. Stop it.

4. Lack of understanding about phantom costs

People believe if you buy a house for $200K and sell it for $450K, you made $250K. This is false. They don’t understand maintenance, taxes, and other phantom costs, and they don’t compare ROI to other investments. Also, did you know real estate prices also go down?

5. Following the same playbook as always

Buying a house was, in general, a good thing for most Boomers. There were also fewer low-cost investment options like index funds in the 70s and 80s. Therefore, stuck in the past, they parrot the same lessons to millennials, who face unaffordable housing, stagnating wages, and better investment options. This is the problem when people (Boomers) recommend something, but don’t actually understand why it works: They just keep repeating it, over and over, even though the situation has changed.

What you should know about buying vs renting

Renting isn’t necessarily better than buying and buying isn’t necessarily better than renting. It depends on many things:

- Your city

- If you’re ready to buy a house

- Why you want a house: to raise a family? Because you want to renovate it? As an investment? Or for pure desire?

My advice: Run the numbers and get educated. But never, ever say you’re “throwing money away on rent.”

Is Renting a Waste of Money? Ramit Sethi Explains is a post from: I Will Teach You To Be Rich.

from I Will Teach You To Be Rich https://ift.tt/3nRWSJc

Comments

Post a Comment

We will appreciate it, if you leave a comment.