If you’re looking for a top-notch budgeting app, PocketSmith deserves a closer look. While it lacks some of the fancy add-ons of some other budgeting apps, like investment management tools, it’s got everything you need on the budgeting side.

In this PocketSmith review, we’ll cover the key features, plans and pricing, and pros and cons. We’ll even share a few PocketSmith alternatives.

Table of Contents

What Is PocketSmith?

Based in New Zealand, PocketSmith was launched in 2008, making it one of the more established personal finance software apps. You can use it to track all your financial accounts on a single platform. By adding your bank, loan, and credit card accounts, and even your investments, you can see the big picture as well as the details in each account.

PocketSmith doesn’t just keep running totals on your account balances. It will also make projections as to where your account balances are headed (as far as 60 years into the future).

Most people have numerous bank accounts spread across multiple banks, lenders, investment accounts, and even retirement accounts, making it very complicated to know where you stand financially at any given moment.

PocketSmith addresses this problem by bringing all your accounts together on one app that allows you to track and make adjustments where necessary.

By gathering all of your accounts on a single platform, you have the ability to make changes to your budget. For example, you may decide to dedicate more funds to paying off debt, building up savings and investments, etc.

As a cloud-based app, PocketSmith allows you to link accounts from 49 countries around the world, including all major banks in the US, Canada, Australia, New Zealand, and the United Kingdom. This is a critical feature in a global economy where both people and money routinely cross international borders.

PocketSmith Features

PocketSmith offers more features than we can adequately cover in this review, but we’ve listed the most important ones below.

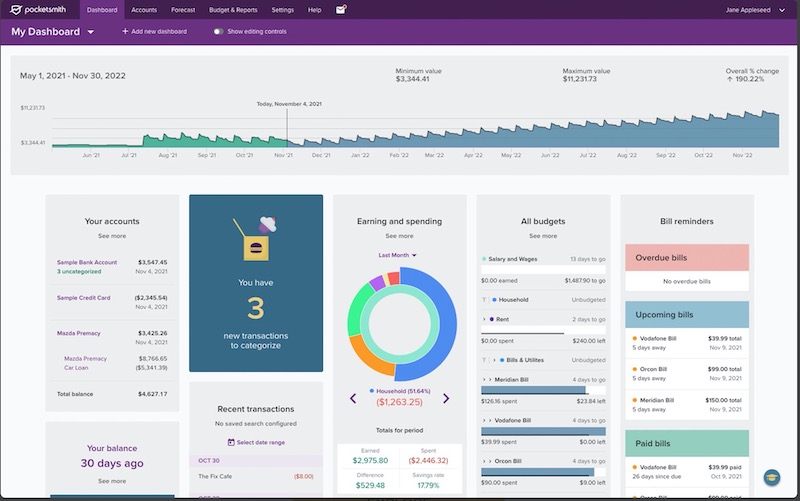

Dashboards

PocketSmith’s dashboard lets you view your current account balances, forecasts, and money metrics. Each plan lets you build multiple dashboards, making it easier to personalize your finances.

For example, you can track your net worth, compare earnings to spending, and review your active budgets and savings goals. The “Your next seven days” and alerts features are also helpful in estimating incoming expenses and deposits to avoid financial surprises.

Live Bank Feeds

This feature is available on the three paid plans. It allows you to connect your PocketSmith account to thousands of financial institutions in 49 countries and have your transactions automatically categorized. Transactions can either be automatically imported or you can choose to upload them manually.

Be sure to choose the mid-tier Flourish or top-tier Fortune plan if you need to link accounts from multiple countries. The app uses Yodlee to connect most global accounts.

Multi-Currency Capability

This may be the most interesting feature of the PocketSmith app. If you have financial assets spread across several countries, the app will provide automatic currency conversions based on daily exchange rates. All accounts, no matter where they’re located, will be converted into your home currency. It even provides extensive exchange rate support for Bitcoin, gold, silver, and other alternative currencies.

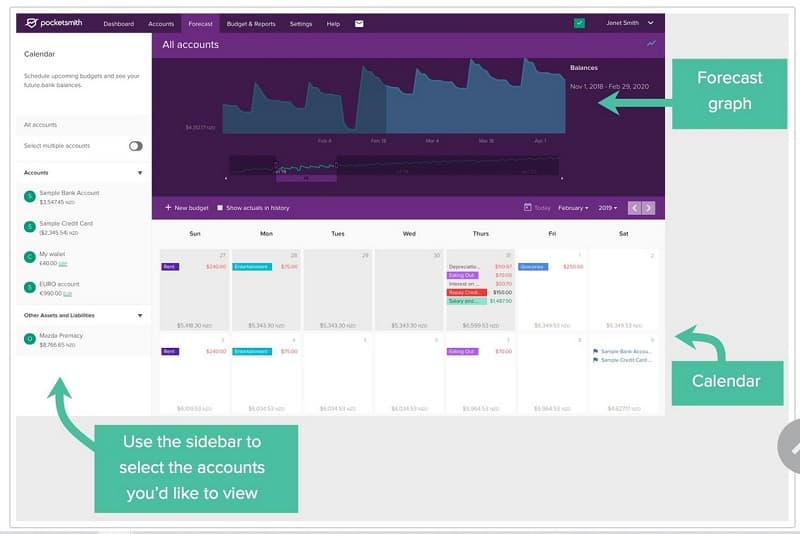

Budget Forecasting

Once your account balances have been imported (or manually entered) into the app, you can make projections forecasting future values out to anywhere from six months to as long as 60 years. The forecasting will even include interest projections and graphs for visual presentation.

Budget Calendar

The Budget Calendar is the heart of the PocketSmith budgeting system, allowing you to create daily, weekly, or monthly budgets and then set up alerts to keep you on track. The app literally displays a calendar giving you a visual presentation of what bills are due and when.

What-If Scenarios

This feature enables you to run different scenarios to test outcomes from the very beginning. You’ll be able to see the results of increasing debt payments or savings contributions and other strategies.

Net Worth Tracking

PocketSmith’s Net Worth Tracking feature lets you see how much money comes in and how much goes out on a regular basis (which will help you to make needed changes). The app can subtract your liabilities from your assets, so it keeps a running total of your net worth (the single most important number in your financial existence).

Advisor Access

If you need help managing your finances, you can give another PocketSmith user access to your account to provide direct management.

How PocketSmith Works

Here are several ways to access the PocketSmith platform to securely and easily access your data.

A “Killer” Search Engine

PocketSmith’s search engine lets you find transactions in a matter of seconds (including older ones). It’s possible to filter events by account, amount, date, label, word exclusion, and other in-depth screens.

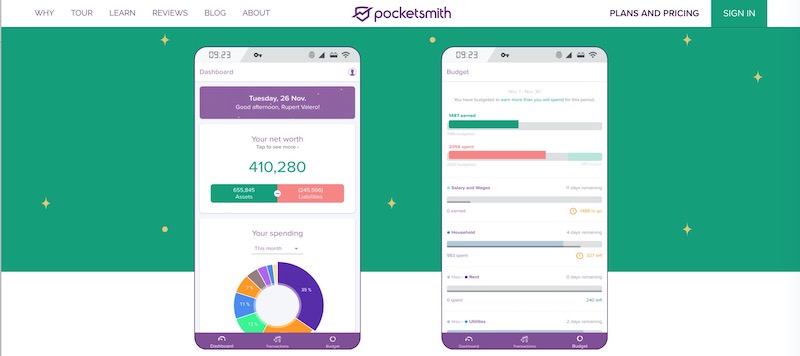

PocketSmith Mobile App

You can access your PocketSmith account using your mobile device. The app is available at The Apple App Store for download on iOS devices (11.0 or later). It’s compatible with iPhone, iPad, and iPod Touch. It’s also available at Google Play for Android devices (5.0 and up).

PocketSmith Desktop App

In addition to a phone and tablet app, computer users can download a desktop app for MacOS (11 or newer), Windows 10 & 11, and Linux (Debian-based distributions). The desktop app has more integration tools than the default cloud-based browser edition.

PocketSmith Security

Bank feeds are delivered through third-party providers Yodlee and Salt Edge (in the UK and EU) and are set in “read-only.” This limits the app to gathering and displaying your information without permitting direct access to your accounts. The app also uses two-factor authentication by sending a code to your mobile device to facilitate logging in.

Customer Support

PocketSmith customer support is available by email only. Because PocketSmith is based in New Zealand, support is available from 5:00 pm to 1:00 AM Eastern Time. Expect responses to take up to one day.

No Advertisements

All PocketSmith plans offer an ad-free experience as the platform relies on monthly subscriptions to pay the bills. This also means that PocketSmith won’t sell your data or promote third-party products, like some free budgeting apps.

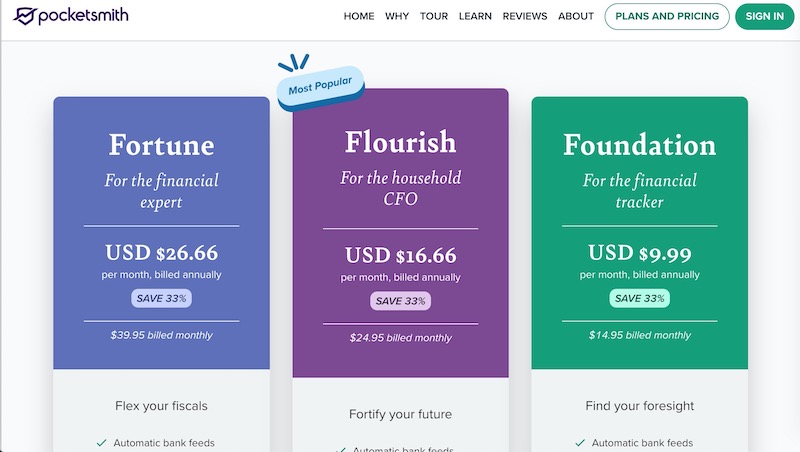

PocketSmith Pricing & Fees

PocketSmith offers four pricing plans, including a free option, so you can select the one that has the features you want and fits within your budget. Consider paying upfront for an annual subscription to get the most affordable rate versus paying month-to-month. You can test out the paid plans with a 30-day free trial.

Free

This entry-level plan doesn’t charge a subscription fee and is sufficient for basic budgeting. It requires manual inputs of your financial information but offers 12 budgets for two accounts and up to six months’ budget projections.

Foundation

The first of the premium plans cost $14.95 per month, or $9.99 if you pay annually ($120). Foundation offers both automatic and manual transaction importing with automatic bank feeds and categorizations for up to six banks in one country.

It also provides unlimited budgets for up to 10 accounts and enables you to make budget projections for up to 10 years.

Flourish

Flourish is PocketSmith’s mid-tier paid plan and costs $24.95 monthly or $200 annually. With Flourish, you can connect up to 18 banks across multiple countries with 18 dashboards. Subscribers can enjoy up to 30 years of projections too.

Fortune

Fortune is PocketSmith’s top-of-the-line plan. It offers all the features of the Flourish plan, but it extends to include unlimited accounts from all countries and budget projections out to as many as 60 years. The plan is available at $39.95 per month, but you’ll save $160 on an annual basis by paying a flat fee of $319 for the whole year.

How to Sign Up with PocketSmith

To get started with PocketSmith, you’ll need to provide your email address and create a username and password. You’ll also need to read and acknowledge several disclosures, including the Terms of Service and the Refund, Privacy, and Cookie policies. Once that’s done, you can hit “Create My New Account” and get started.

From there, select the plan option you want – Free, Foundation, Flourish, or Fortune.

This will determine how you’ll link your accounts, how many accounts you can link, the number of budgets you can create, and the length of the budget projections you can make.

You can also upgrade your plan at any time (for example, switching from the Free plan to the Foundation plan or from the Foundation plan to the Flourish plan, as your finances allow). Conversely, you can also downgrade from one of the paid accounts to the free plan.

For payment purposes, you’ll need to pay using either a Visa or MasterCard, and you can cancel your subscription at any time. Be sure to enable overseas payments or use a card without a foreign transaction fee, as the charge originates from New Zealand.

At this point, you can begin the process of connecting your various financial accounts to the app. PocketSmith connects with more than 12,000 institutions around the world, enabling you to import information rather than enter it manually (though on two of the plans, you do have the option to do manual entry).

Bank feeds can be added either from the Account Summary or Checklist pages.

When you set up bank feeds, you can import up to 90 days of transaction history. Each time the bank feed refreshes, it will search for transactions within the previous 28 days. There’s also the capability to start your transaction history from an earlier date (though you’ll need to follow special procedures to make that happen).

You can also import accounts and transactions from the following software:

- Quicken

- >Microsoft Money

- YNAB

- Buxfer

- Pocketbook

- MoneyWiz

PocketSmith Pros and Cons

Pros:

- Aggregates your financial accounts on a single platform

- Automatically import transactions up to 90 days old from your different bank accounts

- Ability to import data from popular personal finance apps

- Multi-currency capability

- Free plan available

- 30-day free trial on paid plans

Cons:

- No investment monitoring capability

- Can’t pay bills through the app

- The free plan is quite limited

- Premium plans are more expensive than other paid-budget software

- Customer support is very limited (email only)

Alternatives to PocketSmith

The following budgeting apps are worth a look before you sign up with PocketSmith.

Lunch Money

Lunch Money provides multi-currency support, can directly import banking transactions, and has customizable budget categories, tags, and rules. This desktop-first platform also connects to crypto wallets and can upload CSV documents for manual transactions.

Use it to create a monthly budget and calculate your net worth. Enjoy a 30-day free trial and pay $10 per month. Annual subscriptions are also available with a “pay what’s fair” pricing model from $40 to $150 per year.

Unfortunately, Lunch Money doesn’t have a mobile app, so if you prefer to access your budget on-the-go, you may want to look elsewhere.

Read our Lunch Money review for more.

Tiller

People who love using spreadsheets to budget and track their financial data are warming to this practice will feel at home with Tiller. This cloud-based software integrates with Google Sheets and Microsoft Excel to automatically sync with your bank and investment accounts.

All users start with the Foundation Template, which provides a high-level overview of your recent transactions and financial progress. You can add customizable templates for nearly any budgeting strategy to personalize the platform. The annual cost is $79.

Read our Tiller Money review for more.

Rocket Money

Consider Rocket Money if you want a free budgeting app that excels at tracking expenses and making basic monthly budgets. It can also look for ways to reduce your monthly spending but only updates your account balance once per day.

The premium version provides unlimited budgets, net worth tracking, bill cancellation concierge, shared accounts, and real-time account syncing. You will pay between $3 and $12 per month but can enjoy a complimentary subscription if you have an active Rocket Mortgage loan.

Read our Rocket Money review for more.

FAQs

PocketSmith supports over 12,000 financial institutions in 49 countries, including all major banks in the US, New Zealand, Australia, and the UK.

Yes. PocketSmith is available in Canada and connects to several major financial institutions north of the border.

You Need A Budget (YNAB) is a premium budgeting app that follows a zero-based budgeting approach and is one of our highest-rated budgeting tools here at Wallet Hacks. That said, the best budgeting app is the one that’s right for you. And if the features PocketSmith offers better align with how you manage your finances, then you may prefer it to YNAB.

Should You Sign Up with PocketSmith?

PocketSmith is one of the top pure budgeting apps on the market. It performs functions no other budgeting app does, particularly the multicurrency feature, which enables you to maintain accounts in financial institutions worldwide and track balances in your home currency.

With four plan levels, each with its own fee structure, you can choose the plan that will work best within your budget.

The two major negatives of the app are that it doesn’t offer a bill-paying capability or any investment management features. However, if your primary goal is to aggregate all your financial accounts and provide budgeting capabilities, PocketSmith handles those functions expertly.

While customer service is an issue, the Learn Center library of topics is unusually comprehensive. It’s likely you’ll find answers to whatever questions you have somewhere in that section.

If you’d like more information or if you’d like to sign up for the app, visit PocketSmith.

The post PocketSmith Review: The Best Freemium Budgeting App? appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/m5bMq4d

Comments

Post a Comment

We will appreciate it, if you leave a comment.