Stores and restaurants love gift cards. It’s rumored that Starbucks has around $1.6 billion in stored value on gift cards. That’s a $1.6 billion interest-free loan from its customers.

I know we are a contributor of around $25 or so – it’s convenient to load up the app and pay for coffee that way. We don’t mind leaving a few bucks on a Starbucks gift card to facilitate the transaction.

It’s gotten so popular that even our local mom and pop restaurants, places with just a single location, are offering gift cards. It’s possible because they’ve partnered with payment processors, like Toast, to handle the fulfillment.

As a result, they’re able to do something that can also save you money – offer you discounts when you buy gift cards.

That’s the subject of today’s very quick post – how to save money by taking advantage of holiday gift card discount offers.

Table of Contents

How does this hack work?

Very simple – a store will usually offer you some kind of bonus when you buy their gift cards. They don’t offer this throughout the year, it’s typically available around the holidays because they know people like to give out gift cards.

To the store, the pitch is easy – buy (and then gift) our gift cards and you get a little bonus yourself.

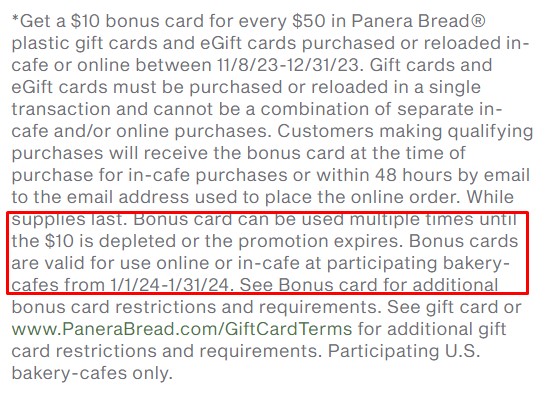

Check out this offer from Panera Bread:

For every $50 in gift cards you buy, you get a $10 gift card for yourself. That’s a bonus of 20% on your existing spend.

Other stores and restaurants may do the offer differently.

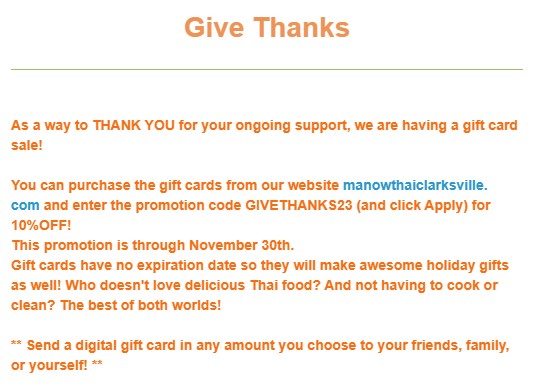

We have a local Thai restaurant that is offering gift cards at 10% off. From now until November 30th, buy a gift card and use their promotion code to get 10% off. The gift card has no expiration date, no restrictions, and it’s a simple 10% off a prepaid meal.

If you’re so bold, you could theoretically calculate how much you spend in a year and pre-pay. The only risk is the opportunity cost of your money being in that gift card or that the restaurant goes out of business!

Who doesn’t love delicious Thai food???

Be sure to read the fine print!

In the case of the Panera Bread offer, the $10 bonus card is available for us from January 1st, 2024 through January 31st, 2024. It’s only a month to use it, so don’t go crazy buying bonus cards unless you know you can spend them in that one month time frame.

*Get a $10 bonus card for every $50 in Panera Bread® plastic gift cards and eGift cards purchased or reloaded in-cafe or online between 11/8/23-12/31/23. Gift cards and eGift cards must be purchased or reloaded in a single transaction and cannot be a combination of separate in-cafe and/or online purchases. Customers making qualifying purchases will receive the bonus card at the time of purchase for in-cafe purchases or within 48 hours by email to the email address used to place the online order. While supplies last. Bonus card can be used multiple times until the $10 is depleted or the promotion expires. Bonus cards are valid for use online or in-cafe at participating bakery-cafes from 1/1/24-1/31/24. See Bonus card for additional bonus card restrictions and requirements. See gift card or www.PaneraBread.com/GiftCardTerms for additional gift card restrictions and requirements. Participating U.S. bakery-cafes only.

With the Thai restaurant offer, there was no fine print or potential gotchas. It was a straight up 10% off their gift card, a nice little discount for prepaying.

Sign up for email lists

The best way to learn about these offers is to sign up for the email lists of the stores and restaurants you frequent. You’ll get a lot of Black Friday and holiday promotional email, but you will certainly get these types of offers sent to you as well.

By being on the email list, you make sure you don’t miss out on the offers.

Remember don’t overspend

A discount is only a discount if you’re saving money that you’re otherwise already spending. We can look back through our expenses to see how much we’ve spent at various restaurants (Chipotle would be very high on that list – our son loves that place!) and budget accordingly.

Know the limitations of the various apps too. For example, Chipotle only lets you use one gift card per purchase on the app. So if they offer something like a $10 gift card, it becomes a bit of a pain to use in the app because you only get one gift card at a time (I don’t believe such a restriction exists in-store).

The post The Holiday Gift Card Saving Hack You Must Know appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/mYiQOHI

Comments

Post a Comment

We will appreciate it, if you leave a comment.