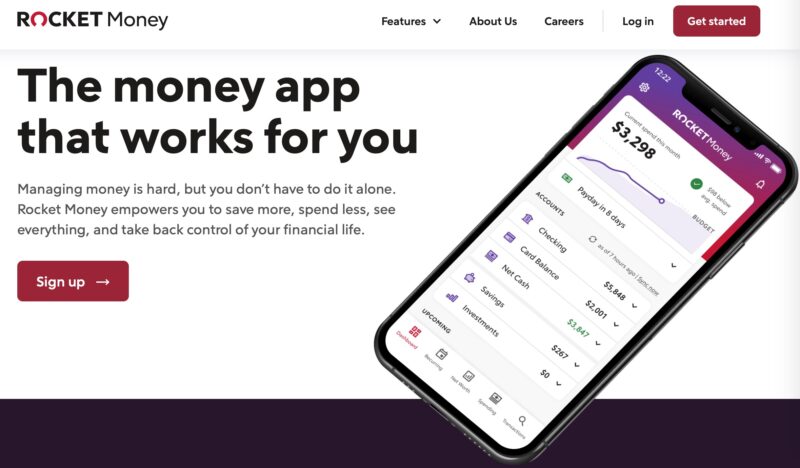

Are you looking for a money app that can help you manage your day-to-day spending? Rocket Money claims to do just that, as well as help you cancel unwanted subscriptions and plan for future purchases.

But is Rocket Money safe to use, and how does it compare to similar budgeting apps like YNAB and Personal Capital? I answer these questions, and more, in this Rocket Money Review.

Table of Contents

What Is Rocket Money?

Rocket Money, formerly TrueBill, is a budgeting app for Android and Apple devices. Unfortunately, they don’t offer a desktop platform, so you must be comfortable using your phone to manage your money.

Free and premium plans are available with various perks.

Some of the member perks include:

- Account tracking

- Automated savings

- Bill negotiation

- Budgeting

- Credit score tracking

You’ll get the most from Rocket Money if you use it to monitor your spending and subscription management tools. Its free tools make it an ideal budgeting app for grads, but the premium subscription remains affordable if you don’t need hands-on budgeting help.

What Happened to TrueBill?

Before mid-2022, Rocket Money was known as TrueBill. The money management app was acquired by Rocket Companies, which also operates the following brands:

- Rocket Loans

- Rocket Mortgage

- LowerMyBills.com

If you already have a Rocket Companies account from one of these other services, you can use your current login details.

How Does Rocket Money Work?

You can follow these steps to join Rocket Money and use it to improve your finances:

- Download the Android or Apple mobile app

- Link your financial accounts

- Analyze spending habits

- Look for ways to save money

- Create budgeting and savings goals

- Monitor financial progress with regular updates.

Rocket Money Pricing

Two different membership plan options are available: Lite and Premium. Pricing for Lite is free, and Premium is $4.99 to $11.99 but features a “Pay What’s Fair” option, which I’ll explain in more detail below.

A 7-day free trial is available on the Premium plan.

Lite

The Lite plan is the standard option and is free for life.

Its benefits can get the job done and include the following:

- Two budgeting categories

- Credit score (no credit report access)

- Link banking accounts

- Low balance alerts

- Daily account syncing

The Lite plan is best if you want to keep tabs on your spending and account balances but don’t need hands-on help canceling or negotiating a lower price for recurring bills.

The budgeting tools are limited to two categories, which can be sufficient to avoid overspending on your most significant monthly expenses.

Premium

The Premium plan offers a 7-day free trial, and then you choose monthly or annual payments:

- Monthly: $4.99 to $11.99

- Annually: $35.99 or $47.99 (billed upfront)

This app follows a “Pay What’s Fair” strategy, so you can decide how much to spend.

According to Rocket Money, the average paid user pledges $6.99 monthly.

To help you decide if Rocket Money Premium is worth it, these are the available perks:

- Unlimited budgeting categories (vs. 2 for the Free plan)

- Credit score and full credit report (vs. credit score only)

- Automated subscription cancellations

- Bill cancellation concierge

- Net worth tracking

- Real-time account syncing (vs. daily syncing)

- Shared accounts

- Premium chat

- Export data

You should consider upgrading to the premium plan if you want unlimited budget categories, shared accounts, or automated subscription management tools.

Rocket Money Features

Account Syncing

Rocket Money links your banking, credit card, and investment accounts through Plaid. This third-party service has read-only access and doesn’t store your sensitive details for extra privacy.

Your account balances update daily the first time you log into your account. The app will send spending insights and alerts when direct deposits hit your account. Linking as many accounts as possible makes it easy to see how much you spend and earn accurately.

After linking your accounts, you can begin categorizing your transactions. Rocket Money auto-categorizes most transactions, so the ongoing maintenance requirements are minimal.

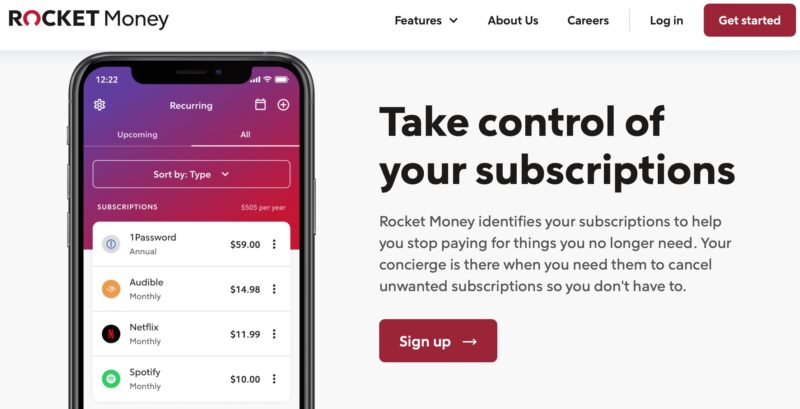

Track Subscriptions

You may have a ballpark estimate about your fixed living expenses, such as utility bills, food, and childcare. Therefore, you have a firm idea of what you can afford on your current income.

Spending $10 or $20 here and there on streaming services may not appear to impact your budget, but several small subscriptions can turn into a surprisingly large amount.

After linking your accounts, Rocket Money looks through your transaction history for recurring subscriptions and lists them in one place.

This feature is a good exercise in determining which services you regularly use and the others you can live without.

Bill Cancellation

Premium subscribers can have the app cancel subscriptions on their behalf. Free users will receive step-by-step directions to stop service, which can save you time despite doing the hard work yourself.

This feature is helpful if you don’t have the time to stay on hold for an extended period or you’re the type to accept offers only to end up regretting the renewal decision later.

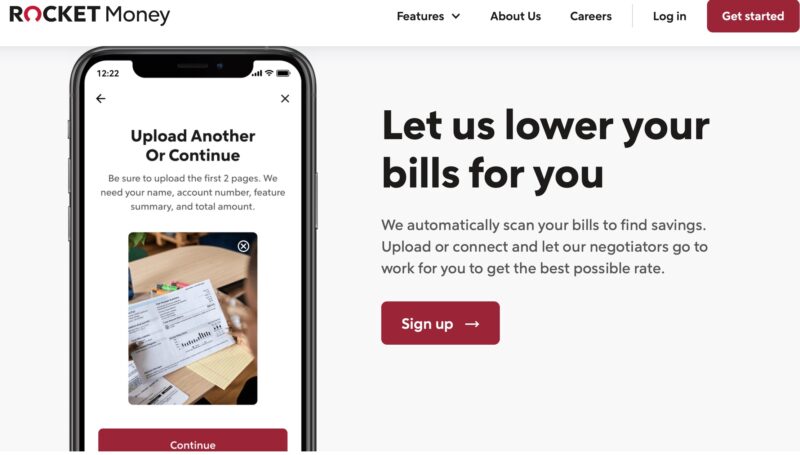

Bill Negotiation

All subscribers can see if Rocket Money will negotiate your existing bills for a lower rate. This is an excellent exercise to practice at least once a year for services you can’t live without to ensure you’re paying the best price.

Some of the best savings opportunities include:

- Cable or satellite TV

- Home Internet

- Postpaid phone plans (i.e., Verizon Wireless, AT&T, and T-Mobile)

- Satellite Radio

- Newspapers

Cable bills and contract cell phone plans have the most potential for discounts. The bill negotiator may see if they can switch you to a newer plan that’s cheaper but has the same features as your existing legacy plan. There may also be loyalty bonuses or limited-time promotions that can reduce your bill for the following year.

The service claims to have an 85% success rate in lowering your bills. You pay a one-time success fee and get to decide how much of the first year of savings to contribute as payment.

Rocket Money can also try to save money on these expenses:

- Car insurance

- Bank overdraft fees

- Bill payment late fees

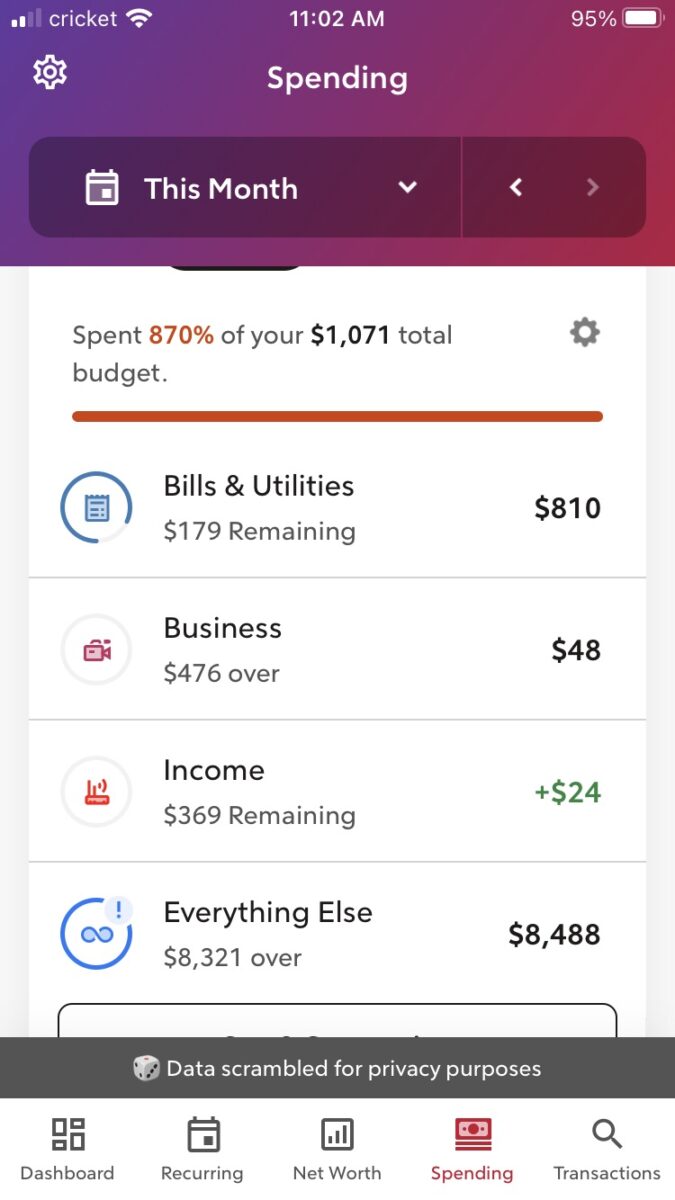

Budgeting

In addition to real-time spending alerts and direct deposit notifications, Rocket Money lets you create a simple spending plan. The budgeting tools are not as powerful as some free budgeting tools, but they can help you quickly see if you’re living within your means for the month.

Lite users can create two budgeting rules, and premium members can make unlimited rules. For example, you may want to create a rule for dining and entertainment, which are variable but controllable expenses.

This budgeting app generates a monthly report summarizing your spending and income patterns. It’s also possible to analyze these topics throughout the month:

- Bills paid

- Current spending

- The income left for savings.

- Money left for spending

- Monthly earnings so far

Most reports are available on a weekly, monthly, quarterly, or yearly period.

Budgeting as a couple with the Shared Accounts feature available to premium subscribers is also possible.

Bill Reminders

The app displays bill payment reminders and the payment due date, making it easier to plan ahead, so you don’t forget to pay a bill. You may still need to fine-tune your spending plan for variable bills such as your electric bill.

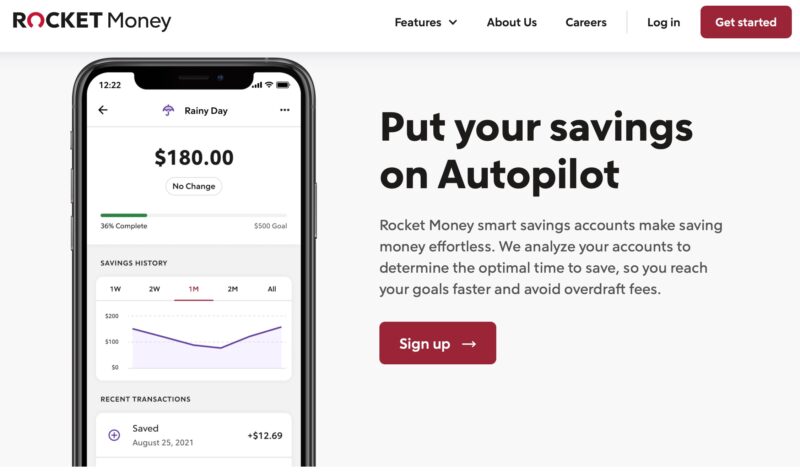

Automated Savings

Premium subscribers can use the Smart Savings feature to contribute to their savings goals automatically. You can decide how much to save and how frequently to withdraw from your linked checking account.

To prevent account overdrafts, the service skips withdrawals when you have insufficient funds in your account.

Your cash goes into an FDIC-insured account until you’re ready to spend it. Unfortunately, you may not earn interest on these deposits. Instead, consider a high-yield savings account to make money on your short-term savings.

Net Worth Tracker

A paid subscription can also track your net worth through your linked accounts. This feature may not be as essential as budgeting or tracking spending, but it’s another way to monitor your financial progress.

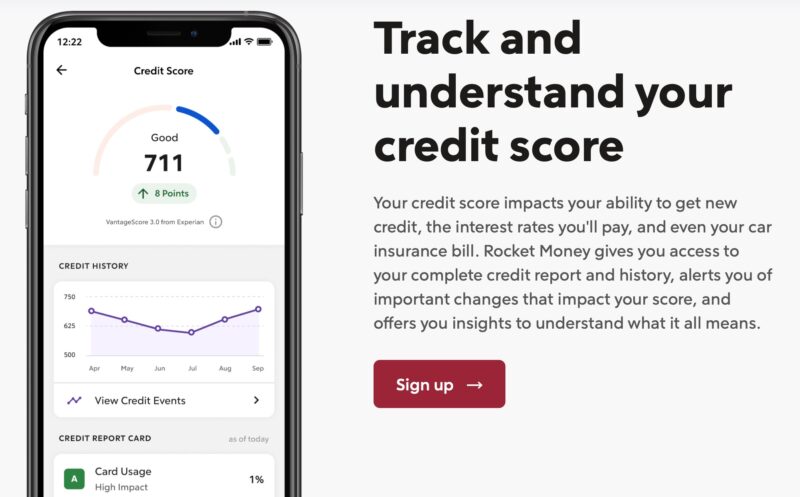

Credit Score Monitoring

Lite users can view their Experian VantageScore 3.0 credit score for free. The app refreshes your score monthly. Although this isn’t the same score that most lenders use to make credit decisions (that would be the FICO Score from the Fair Isaac Corporation), it will give you a good estimate of your creditworthiness.

You can also see areas of improvement that can help you achieve a good credit score. However, free subscribers won’t be able to access their credit report.

Premium members have the opportunity to view their full Experian credit report. This report updates monthly, so be sure to access it regularly to avoid missing a monthly update.

This is a nice feature, and it’s helpful in assessing your complete financial picture. Keep in mind there are several ways to check Your credit score for free with more constant updates. Other credit monitoring services may retrieve your score from more credit bureaus and possibly offer your FICO Score.

Rocket Money Pros and Cons

Rocket Money can handle many day-to-day budgeting tasks. It’s got some clear benefits and a few drawbacks, too. Here’s my list of Rocket Money pros and cons:

Pros

- A free plan is available

- Syncs to accounts

- Multiple money management features

- “Pay what’s fair” option on the Premium plan

Cons

- Best features require a paid subscription

- Credit score monitoring only updates monthly

- Mobile-only

Is Rocket Money Safe?

Yes, Rocket Money is a safe way to monitor your banking account transactions, look for ways to reduce spending, and track your credit score.

The app uses the same third-party service (Plaid) to connect to your accounts as most personal finance software apps. This software doesn’t store personal information on its servers and uses bank-level security to protect your account. In addition, when you need to share your data with others, you can scramble your data for additional privacy.

Alternatives to Rocket Money

Rocket Money can help improve your finances, but these other services can be better if you need hands-on help with a specific need.

YNAB

If you require serious budgeting help to stop living paycheck to paycheck, You Need A Budget (YNAB) is an excellent option. This budgeting app requires a paid subscription ($14.99 monthly or $99 annually), but you have a 34-day free trial to decide if it’s a good fit.

The YNAB budget follows a zero-based budget approach, assigning each dollar to a specific task. So, you have the plan to spend or save every dollar that you make.

The app walks you through the budgeting process and reviews many monthly expenses that are easily overlooked with basic budgeting tools like Rocket Money or Mint.

The spending and net worth reports are also robust. There are also several financial calculators to help you plan upcoming goals. For more information, check out our full YNAB review.

Personal Capital

Personal Capital is arguably the best free net worth tracker available today, as you can link your banking accounts and add manual accounts. The service includes basic spend tracking tools to categorize transactions and ensure you live within your means.

Creating savings goals and reviewing your investment portfolio’s asset allocation and fund fees is also possible. Read our Personal Capital review for more information.

Learn More About Personal Capital

Trim

If you just want a service to negotiate bills, then consider Trim. The app can perform these services, usually for free:

- Reduce cable, phone, and internet bills (15% success fee of annual savings)

- Cancel unwanted subscriptions (Free!)

- Negotiate medical bills (Free!)

- Lower APRs and bank fees (Free!)

You can also monitor transactions and automate savings for upcoming goals for free.

Mint

Mint provides many of the same budgeting and credit monitoring tools for free. Unfortunately, it means that you will see annoying ads and product offers as you use the app.

For budgeting, you can create multiple categories after connecting your accounts. This app has some of the best free budgeting tools.

The service can also negotiate bills and cancel unwanted subscriptions. All users can also view their credit score and a credit report summary for free.

FAQs

You can send a chat message within the app; the typical response time is within one day. Additionally, premium members receive priority support. An extensive online FAQ section also provides tutorials for the free and paid features.

It’s possible to monitor your banking accounts, credit scores, and subscriptions for free. However, you must pay at least $4.99 monthly (or $35.99 annually) for unlimited budgeting rules, subscription cancellation, and other in-depth access.

Rocket Money won’t sell your personal information and protects your privacy. However, you may receive offers from other Rocket companies and third-party affiliates.

The Bottom Line on Rocket Money

Rocket Money can be an effective way to make a free budget if you want to track spending easily and don’t need hands-on help. The paid subscription is worth it if you need unlimited budgeting access and other money-saving tools. The “Pay What’s Fair” option makes it an even better value.

But while the app has several additional features, not all are useful. If you’re looking for more in-depth tools for budgeting or tracking your spending, consider other options, such as YNAB or Personal Capital, in addition to Rocket Money.

The post Rockey Money Review: Is Rocket Money Safe? appeared first on Best Wallet Hacks.

from Best Wallet Hacks https://ift.tt/p6BZ0u3

Comments

Post a Comment

We will appreciate it, if you leave a comment.