Square’s Free Card Reader is a cutting-edge device designed to empower small business owners to manage their finances efficiently while easily accepting payments from customers. The reader presents a cost-effective solution for businesses of varying sizes, whether operating in a physical storefront, online, or both.

I got my free reader from Square over ten years ago when I was launching FinCon and knew I would need to take payments on site at the event. It worked out great!

Square is a premier provider of financial and payment services for small businesses. Its platform streamlines payment processing and financial management, enabling small business owners to grow their operations confidently.

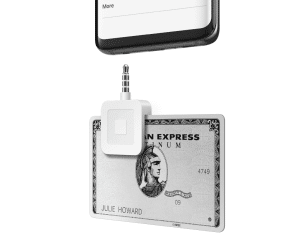

The Square Free Card Reader is a compact, lightweight device that facilitates customer card payments via smartphones or tablets.

The reader is designed to be simple to set up and use. Simply connect it to your mobile device, and you’re ready to start accepting payments.

This guide provides an in-depth look at Square’s Free Card Reader, covering everything from setup to usage and its features. Whether you’re a budding entrepreneur or an established business looking to broaden payment options, this guide will aid you in maximizing the capabilities of Square’s Free Card Reader.

Square’s free credit card reader works with the free Square Point of Sale app to let everyone accept payments on their smartphone or tablet.

Where to Get the Free Square Reader

Let’s delve into the details:

- Square’s Website: The Free Card Reader can be directly acquired through Square’s official website. The process involves selecting the reader, followed by a straightforward checkout procedure. If you want a second reader, it’s only $10.

- Retail Availability: The reader is readily accessible through various retail channels, including office supply stores and e-commerce platforms. To guarantee that you’re obtaining the correct product, ensure to look for the label “Square Free Card Reader.”

- Delivery and Shipping: Square offers complimentary shipping for the Free Card Reader, and delivery times may vary based on your location. Expect the reader to arrive within 5-7 working days.

- Reader Selection: Square offers a variety of card readers to choose from, including the Free Card Reader, Chip Card Reader, and Contactless and Chip Card Reader. When selecting a reader, assess your business needs and the type of payments you’ll be processing.

Whether starting a new venture or expanding payment options, the reader provides a practical and economical solution to grow your business.

Getting Started with the Free Card Reader

The initiation process for Square’s Free Card Reader is easy. Follow these steps:

- Compatible Mobile Device: A smartphone or tablet compatible with the Square Free Card Reader is necessary. The device must run either iOS 11.0 or higher or Android 6.0 or higher.

- Square Point of Sale App: The Square Point of Sale app, available on the App Store or Google Play Store, provides the necessary tools to manage transactions and monitor sales.

- Internet Connection: An active internet connection is a requirement for the proper functioning of the Square Free Card Reader.

With these things in place, let’s delve into the setup process:

- Reader-Device Connection: Connect the Square Free Card Reader to your mobile device by plugging it into the headphone jack.

- Launch Square Point of Sale App: Open the app on your device and log in to your Square account. In case you don’t have a Square account, sign up for one from within the app.

- Reader Configuration: Follow the on-screen instructions to configure the reader, including pairing it with your device and setting up payment preferences.

- Payment Acceptance: Upon successful setup, the reader is ready for use, enabling payment acceptance via card swipes, dips, or taps.

In the subsequent section, we’ll delve into the usage of the reader for accepting customer payments.

Accepting Payments with Square’s Free Reader

The reader integrates with the Square Point of Sale app, which offers a straightforward and user-friendly interface for managing transactions and tracking sales.

Here’s a step-by-step guide on using the Square Free Card Reader for payments:

- Transaction Initiation: Within the Square Point of Sale app, select the “Charge” option to initiate a transaction.

- Transaction Amount Entry: Enter the transaction amount into the app. The app will prompt you to swipe, dip, or tap the customer’s card.

- Payment Processing: Process the payment by swiping, dipping, or tapping the customer’s card. The app will securely process the payment through communication with the reader.

- Receipt Generation: The Square Point of Sale app will automatically generate a receipt for the customer, which can be sent via email or text.

In the next section, we’ll examine the features of the Square Free Card Reader, including its capabilities for managing business finances.

Features of the Free Card Reader from Square

This compact and convenient tool offers a plethora of features, including:

- Universal Accessibility: The free card reader is an all-encompassing solution, as it seamlessly integrates with both iOS and Android platforms.

- Effortless Functionality: With its plug-and-play design, the free card reader is the epitome of ease of use. Simply connect it to the headphone jack of your mobile device, and you’re ready to roll!

- No Monthly Obligations: Say goodbye to recurring fees and hello to financial freedom! The free card reader is devoid of any monthly charges, making it an ideal option for budget-conscious business owners.

- Unwavering Security: Square leverages cutting-edge security measures to ensure that all transactions processed through the free card reader are protected.

- Immediate Funds Availability: The free card reader enables merchants to receive payments in real-time, affording them instant access to their hard-earned funds.

- Contract-Free Flexibility: The free card reader is devoid of any long-term commitments, offering users the autonomy to discontinue usage at their discretion.

Reader Safety and Security

Let’s delve into the key components of Square’s Free Card Reader that make it a secure solution for your payment processing needs:

- Data Defense: Square fortifies your information through encryption, securing your transactions from the very start. The reader encrypts card data at the point of sale, providing an impenetrable barrier against data breaches.

- Conflict Conquering: Square has you covered in case of any disputes or issues with your transactions. The company provides dispute resolution services to assist in resolving any customer disputes.

- Fraud Fighting: Square employs sophisticated fraud detection algorithms to safeguard against fraudulent activities. If suspicious behavior is detected, Square flags the transaction and works with you to resolve the matter.

- Reader Reliability: To maintain the security of your Square Free Card Reader, it’s crucial to keep your smartphone or tablet locked when not in use and store the reader in a safe place.

By utilizing Square’s Free Card Reader and adhering to these best practices, you can have complete peace of mind, knowing that your transactions and personal information are secure.

Conclusion

If you’re a small business owner, Square’s Free Card Reader is a great choice. It’s easy to use and set up, it won’t cost you anything, and it has lots of features to help you accept payments from customers.

Whatever size business you have, the reader can offer you a secure and reliable solution – so if you want an effective way of taking payments, this reader should definitely be on your list!

Square’s free credit card reader works with the free Square Point of Sale app to let everyone accept payments on their smartphone or tablet.

The post The Free Square Reader: Get One in 2023 appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/EjHOXbr

Comments

Post a Comment

We will appreciate it, if you leave a comment.