![]() Are you looking for a bank account for your small business? There are plenty of options out there but NorthOne’s account might be the best choice for you.

Are you looking for a bank account for your small business? There are plenty of options out there but NorthOne’s account might be the best choice for you.

In this review, I’ll share my personal experience with NorthOne, including their strengths and weaknesses so you can make an informed decision about whether or not to open up an account.

In short, NorthOne offers a number of advantages, including its simple fee structure and its implementation of the Profit First “envelopes” system. However, they lack business savings and their mobile deposit feature can be clunky and finicky, making it difficult to deposit checks.

Let’s dive in and take a closer look at NorthOne so you can decide if this company is right for your small business.

Overview of NorthOne and the Small Business Deposit Account

NorthOne is a financial technology startup that focuses on making banking easier for small business owners. NorthOne was founded in 2017 by Eytan Bensoussan and Justin Adler and launched to the public in August 2019.

NorthOne offers business accounts to small businesses across America, and their accounts are FDIC-insured up to $250,000 by The Bancorp Bank, Member FDIC. Their mission is

“to eliminate financial administration for business owners so they’re able to focus on what really matters: growing a successful business.”

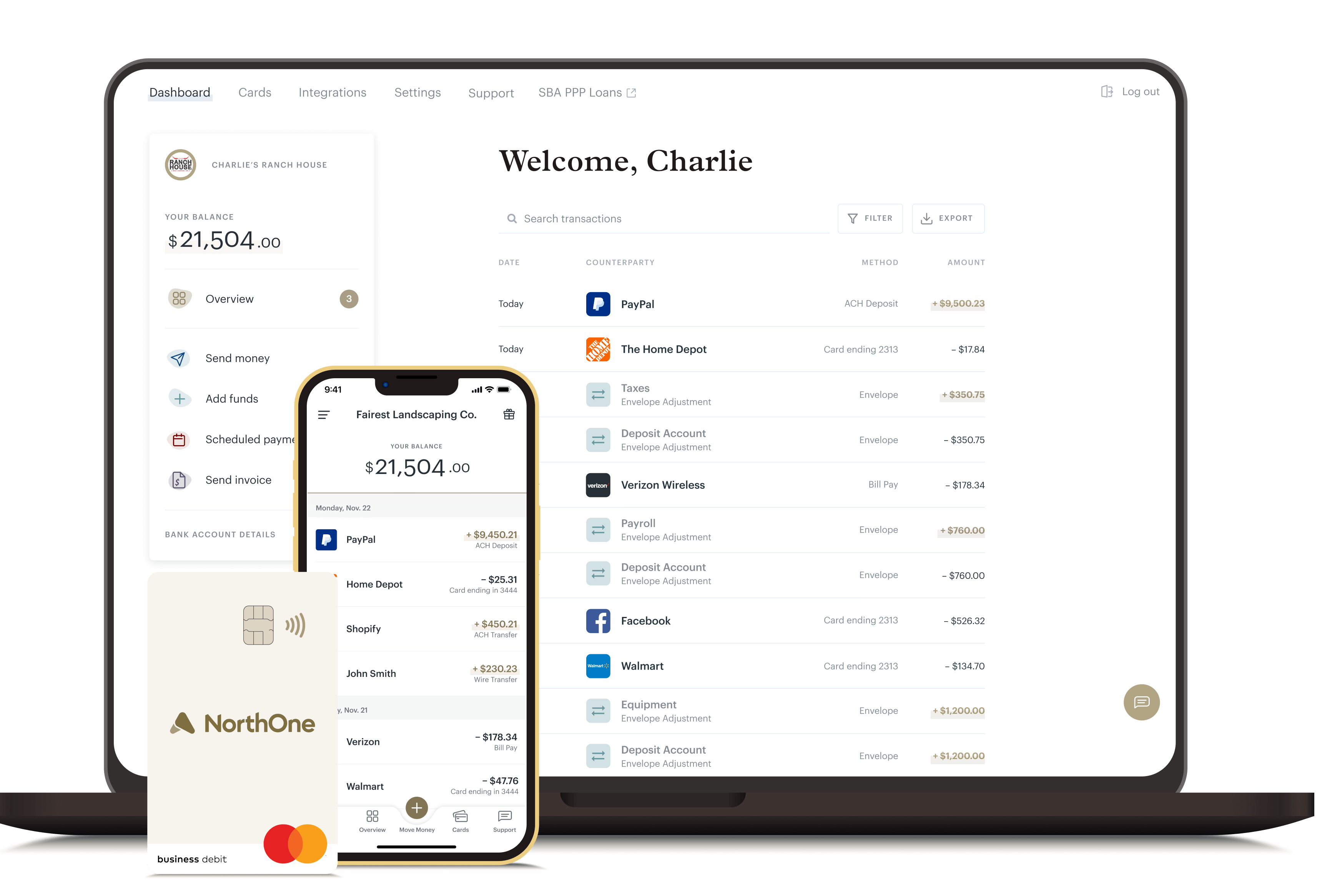

The NorthOne Small Business Deposit Account comes with features such as free debit cards, multiple transfer options, and real-time transaction tracking. Let’s take a closer look at the features of this account so you can decide if it’s right for your business.

Free Debit Card – Get a free debit card to use for your business spending and ATM withdrawals.

ACH and Wire Payments – Make payments quickly and securely with ACH transfers or wire payments to vendors.

Real-Time Transaction Tracking – Track all your deposits, withdrawals, and transfers in real time from the NorthOne app.

ATM Usage – With NorthOne, you have access to ATMs worldwide so you can withdraw cash when needed. See their list of ATMs here. While NorthOne doesn’t charge you an ATM fee, the ATM might.

Security & Fraud Protection – NorthOne provides a high level of security and fraud protection. They use biometric authentication and fraud monitoring. They are also FDIC-insured.

Customer Support – NorthOne offers 24/7 customer support. Their support email is support@northone.com; their support phone number is 332-205-9253.

Mobile App – NorthOne offers a mobile app that allows you to manage your account on the go.

NorthOne Fees – NorthOne fees are clear and upfront. All NorthOne customers pay a flat $10 Monthly Account Fee. This fee gives you access to all NorthOne’s offerings without additional fees for card purchases, Standard ACH payments, deposits, and more.

Other fees you may see:

- $15 fee for sending and receiving domestic wire payments

- $5 fee for sending a same-day ACH transfer

- $4 fee for sending a physical check

- ATM withdrawals may also have a fee, charged by the ATM owner

More NorthOne Info

Initial Minimum Deposit: $50

Routing Number: 236070545

Bank Locations: None, they are a technology company, not a physical bank with branches.

Zelle, Cash App, Venmo: NorthOne does NOT work with these instant transfer companies.

Strengths of the NorthOne Account

- Simple & Clean Interface – NorthOne has a simple and clean interface both online and in the app. It’s easy to use, understand, and navigate.

- Profit First Envelope System – NorthOne supports Mike Michalowicz’s profit first envelope system for entrepreneurs and small business owners. This gives you more control over your money by ensuring that you are putting a certain amount of profits away each month before anything else.

- Useage Incentives – NorthOne offers rewards for using their debit card. This helps negate the monthly fee of $10 charged by NorthOne. They were constantly incentivizing me to use the debit card by offering to pay for a $20 lunch.

- Easy to Use Interface – NorthOne’s interface is clean and simple to use, understand, and navigate. They make everything clear so that you can take control of your finances with minimal hassle.

- Integrations – NorthOne also integrates with popular apps like Airbnb, Alto, Amazon, Etsy, Gusto, Lyft, PayPal, Quickbooks Online, Shopify, Square, Stripe

- Personalized Customer Service – NorthOne is a smaller bank compared to some of the other big ones out there but this doesn’t mean they don’t offer great customer service. Whenever I had an issue or question, I could always get a hold of someone (through chat or phone) within minutes who was helpful and knowledgeable about my account.

Weaknesses of the NorthOne Account

- Limited Products – NorthOne has limited offerings right now. A small business banking experience should include savings, lending, and payment processing. One day they may have those services, but right now they don’t.

- Issues with Mobile Deposit – Their mobile deposit feature is a bit clunky (they use a 3rd party service) and they rejected more checks than they actually deposited. When I contacted them about the deposit issue, they kind of threw their hands up about the issue.

- $10 Monthly Fee – While $10 isn’t much (and they do look for ways to help negate it), there are other banks that are completely free.

Final Thoughts on NorthOne: Who Should Use It?

NorthOne is a great fit for small business owners and freelancers who aren’t afraid of a simple fee, yet don’t need bigger bank solutions. It works if you’re comfortable with a fully online banking experience and you understand the benefits of their software integrations and the Profit First system.

But if those things aren’t important to you, then it’s best to look for another bank that might provide different features. I used them for over six months and ultimately decided to leave for another bank. I’m currenlty with Live Oak Bank.

NorthOne Bonus to Get Started

NorthOne is offering a bonus to customers who sign up and use the app. If you open an account with NorthOne here, they’ll waive the first months fee (aka, $30 off).

That’s a great way to get started with them and test out their services without having to pay anything. You can see if they meet your banking needs before deciding whether or not to stay with them long-term.

Note, there is another bonus out there being stated as a $20 bonus, but it’s just two months free. The link for the three months free is the best offer going.

The post NorthOne Bank Review: My Thoughts After 6 Months appeared first on Part-Time Money®.

from Part-Time Money® https://ift.tt/1MjWgBJ

Comments

Post a Comment

We will appreciate it, if you leave a comment.