Taking control over your finances becomes more and more important as you get older. The time will come when you’re fully independent and expected to pay for rent, food, and utility bills all on your own. Taking the time to learn how to budget and manage your money now will set you up for financial success in the long run. Continue reading for 15 money management tips for young adults that will help you embrace your newfound freedom and live life without unreasonable financial barriers.

15 Financial Tips for Young Adults

1. Practice Self-control

One of the challenges of young adulthood is learning how to spend money responsibly. It’s easy to go to the mall and purchase a pair of sneakers on your credit card, not worrying about paying it off until the end of the month. But it would be smarter to wait until you know you have the cash, so you avoid paying unnecessary interest.

If you use credit cards for most of your purchases, remember to pay your bill in full every month. Leaving unpaid balances creates the opportunity for you to fall into debt and puts your credit score in jeopardy. When dealing with credit cards, always spend within your means and never open or carry more than you’re able to keep track of. Practicing this kind of self-control will allow you to better manage your finances and build a positive credit history.

2. Control Your Own Financial Future

When learning how to manage your finances and plan for the future, you’re going to run into many different opinions. Your aunt may think it’s smart for you to invest in real estate and your dad may tell you to put your money in stocks. However, no one knows your finances better than you.

Avoid relying entirely on the advice of others and take charge of your own financial future. Look for books about personal finances to give yourself some direction. After you’ve done your own research, structure your finances how you see fit so you’re never caught off guard or feel anxious about what to do with your money.

3. Track Spending

Take a moment to look at how you spend your money every month. It’ll be helpful for you to see exactly how much of an impact going to Starbucks every day makes. With a bird’s-eye view of how you use your monthly income, you can make the necessary changes to have more control over your spending habits. With the help of apps like Mint and its budgeting tools, you can easily keep track of how much you’re spending and where, so you can manage your money properly.

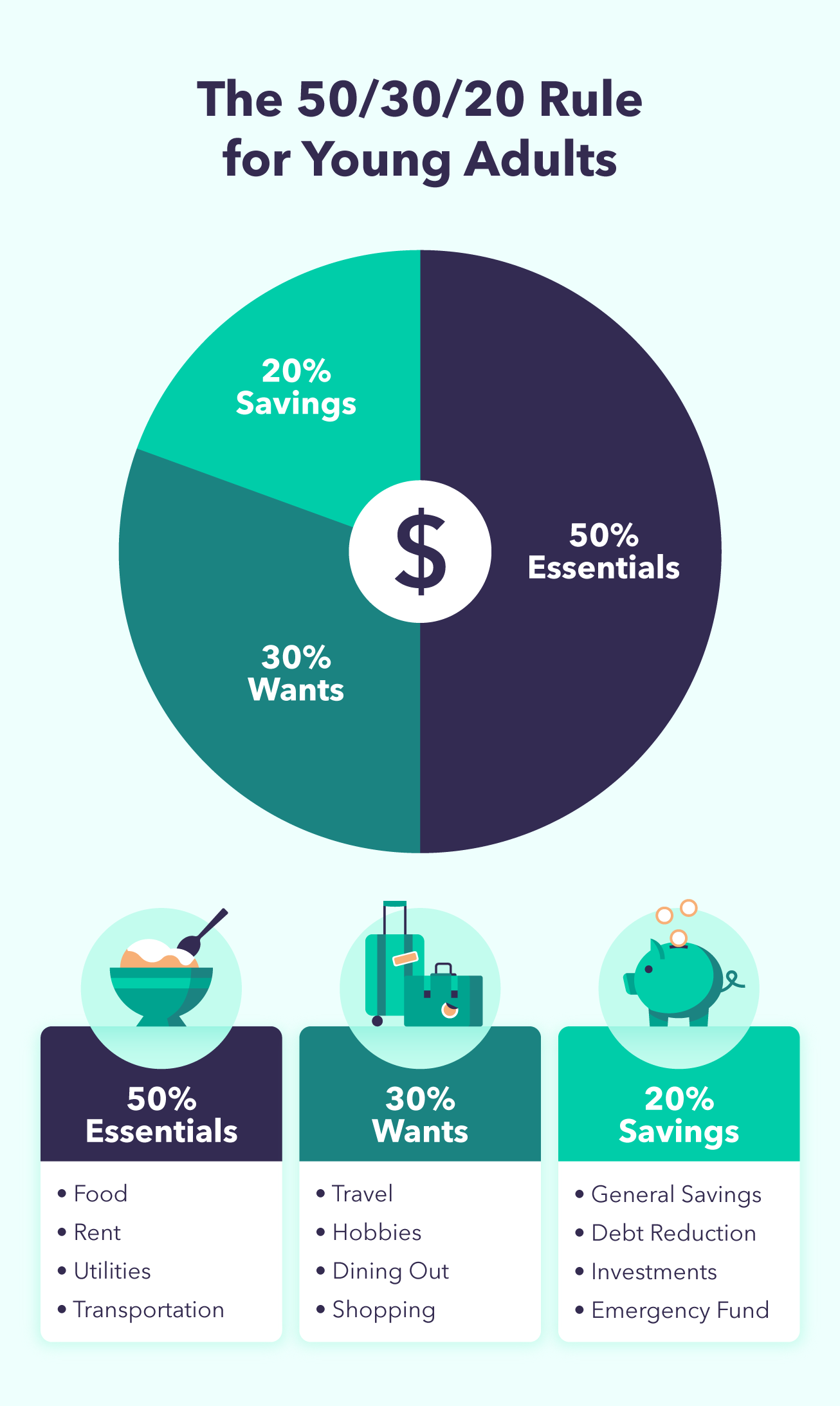

4. Adopt the 50/30/20 Rule

The 50/30/20 rule is a tool used by money-conscious individuals who want to align their savings goals with their spending habits. The budgeting system works by pooling your after-tax income into three separate categories: essentials, wants, and savings.

Fifty percent of your money will go toward essentials — these are bills and expenses you must pay every month such as housing, food, and transportation. Thirty percent is then put toward wants for the month. Think of this as your discretionary money that you can use for things like your daily coffee runs or weekend adventures. Dedicate the last 20 percent to your savings. Worry about this category after you pay for your essentials, but before you dip into your discretionary money. This will allow you to spend confidently, knowing you’ve taken care of all your financial responsibilities for the month.

5. Start an Emergency Fund

It’s critical to prioritize your financial stability by establishing an emergency fund that you can fall back on if needed. Regardless of how low your salary is or the amount of credit card debt you’ve accrued, always make sure to save a portion of your income for an unexpected rainy day — as a general rule of thumb, aim to save around 3-6 months’ worth of income. With those savings nestled away, you can sleep more comfortably knowing you’re prepared for any potential financial troubles that may come your way.

Once you’ve gotten into the habit of treating your savings as a nonnegotiable expense, you’ll soon find that you’ve put enough away to go toward a retirement plan or your first home’s down payment. To prevent inflation from eroding the value of your money, consider looking for a money market account to place your money in. Just be sure that this account will allow you to access your money quickly in the event of an emergency.

6. Negotiate Salaries

When looking for ways to save more money, people usually have two options: lower expenses or increase monthly salary.

The first option is often chosen because it’s less intimidating. However, pursuing a new high-paying job opportunity by working with your current employer to negotiate a higher salary is a way to improve your quality of life without sacrificing some of the things you love. The worst thing they could say is no. But if they say yes, you’ll be able to save a little more every month or take that weekend road trip you’ve been planning.

7. Protect Your Wealth

It’s essential to protect the wealth you’ve worked hard to earn. There’s no worse feeling than one day waking up to an empty account balance. Remember that inflation can eat away at your money if you’re not careful. Look for a high-interest savings account that will allow you to earn more money over time with little financial risk.

Insurance is another way to protect your wealth. If you’re a renter living in an apartment, purchase renters insurance to protect your belongings in the event of a fire or burglary. You can also look into disability income insurance, which protects your ability to earn income. In the event you fall ill or become injured, you will have a steady stream of income to keep you afloat for an extended period of time while you recover.

8. Save for Retirement

The first thing to remember about saving for retirement is that the earlier you start, the better off you’ll be. Compound interest can be hard to understand, but the basic principle is that the sooner you begin saving, the less money you’ll need to invest to reach the amount you need for retirement. So in reality, the $100 a month you put away now will be more valuable than the $1,000 a month you begin saving 20 years from now.

Seeking out company-sponsored retirement plans is a great way to get started. These plans offer employees the ability to invest pre-tax dollars into their retirement account with the company matching a certain portion of the employee’s investment. This helps you prepare for a secure financial future while enjoying the life you’re living now.

9. Guard Your Health

Even though our goal every month is to keep as much money in our pockets as possible, it’s not smart to dismiss medical insurance as an unneeded expense. Have you thought about what you’d do if you have to go to the emergency room for a small accident? One visit can cost you thousands in medical fees. This small investment every month will limit your risk for financial setbacks and provide you access to the medical care you need to stay healthy.

If you’re currently employed, your job may offer health insurance through high-deductible plans that help you save on coverage premiums and make you eligible for a health savings account (HSA). If you need to buy health insurance independently, you can browse different offerings on the Affordable Care Act’s Health Insurance Marketplace. Here they provide information on federal and state plans that you can compare to find the price that works best for you and your budget.

10. Learn How to File Taxes

Taxes can be intimidating for those without experience filing them every year. If you’re intimidated or run into trouble, keep in mind that there are tons of software programs available that make the process incredibly streamlined and painless for the filer. TurboTax is one of the tax filing tools used by millions every year. However, make sure you’re not losing out on any money as you go through the process. There are a lot of deductions people aren’t aware of that could put money back into your pocket.

11. Keep Your Credit Score High

An important factor influencing your financial well-being is the strength of your credit score. From opening credit cards to securing your first apartment or qualifying for an auto loan, your credit score and history play an important role in your life as an adult. By paying your bills on time and maintaining a good debt-to-asset ratio, you’ll be able to take on life’s most memorable endeavors knowing your credit will work in your favor.

12. Diversify Income Streams

The days of working a 9-5 job for 50 years in hopes of saving enough money for retirement are quickly fading. Younger generations are making a shift toward freelancing and entrepreneurship to take control of their own careers and financial futures. This trend has made sourcing multiple revenue streams easier, as you can build a portfolio of different clients to work with or generate passive income.

Looking for a side hustle to boost your income? Here are a few ideas to make some extra money on the side:

- Food delivery services

- Blogging

- Tutoring

- Car rental services

- Ridesharing

13. Don’t Fall for the Social Media Hoax

Social media and the lifestyles portrayed by influencers can lead you to question what you’re doing wrong with your life. It’s hard seeing people the same age as you driving around in luxury vehicles flaunting their expensive clothes and jewelry. Even though it can be difficult, try not to get tricked by these facades.

Many of today’s influencers are renting houses and vehicles to showcase a lifestyle even they can’t keep up with. Spending your money attempting to live up to an unrealistic lifestyle will quickly sink you into debt. You don’t need to delete social media entirely — just try to pay less attention to what you wish you had and be more appreciative of what you do.

14. Try Personal Finance Apps

For many years, young adults have avoided taking control of their finances because there was no simple way of doing so. With the help of Mint’s personal finance app and other similar tools, you can have one central platform to track your budget and stay informed on how you’re managing your finances. The features and designs on these apps make them much more engaging and fun to explore. You can forget all the spreadsheets and calculations and just turn to your phone to do the work for you. Honestly, what could be better?

15. Talk to a Financial Advisor

Many times people will only seek out financial advice when they either have a lot of money or just went through financial trouble and are seeking guidance. Avoid falling into either of these categories and be proactive. It can never hurt to get advice on how to reach your financial goals. Even if you haven’t made any, an advisor can help you create a budget and put some goals in place. Their job is to help you build a future for yourself that you can look forward to.

There’s no better time than now to take control over your budget and spending habits. You don’t need to be an expert in math or a professional in taxation. By following these 15 tips, you’ll be able to set yourself up for success when it comes to your financial future.

Sources: Investopedia | Healthcare

Related

from Personal Finance – New Finance Magazine https://ift.tt/3Bd2VMg

Comments

Post a Comment

We will appreciate it, if you leave a comment.